The good thing about investing for the long term is that makes you less nervous about very short-term price action. If a business keeps growing profitably, then valuations will rise with it over time.

Then there is any sort of scary news, including Russia starting a possible war with consequences difficult to predict.

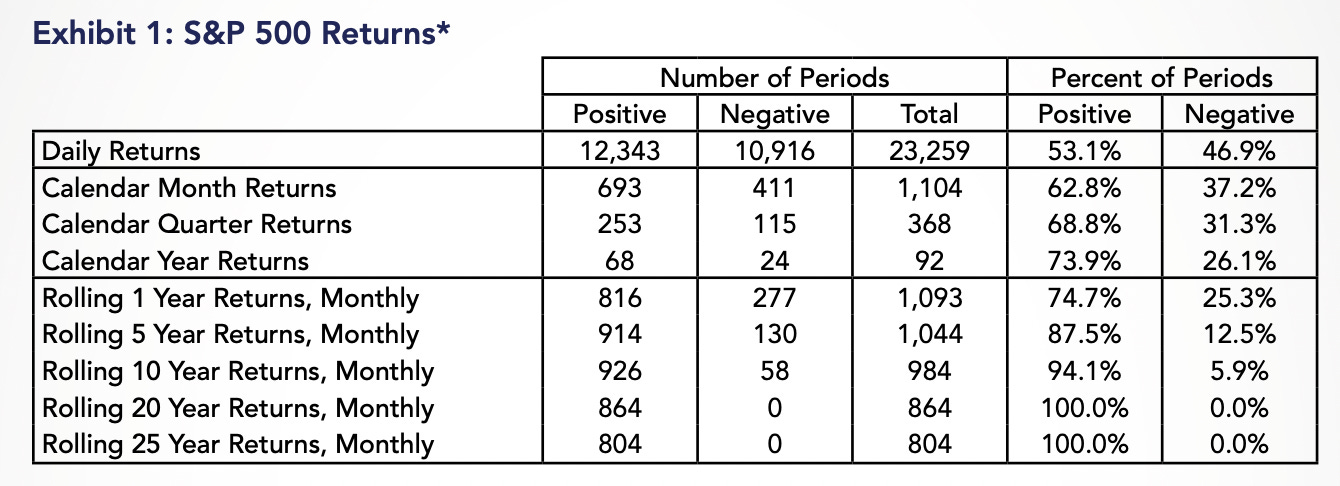

Because volatility can hurt, here is a statistic that made me zoom-out and develop some patience.

Since its inception, the SP500 has had:

53% of positive days

63% of positive months

69% of positive quarters

75% of positive years

88% of positive 5 years periods

94% of positive decades

100% of positive 20 year periods

Let's zoom out, be patient, keep investing through dollar-cost averaging, and stay positive!

-

Important:

this is not investment advice. Consult a licensed financial advisor before making any investment decision.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.