Today I’m adding 3 names to my 10X FREE POT portfolio. Tomorrow I’ll add 4 names to my 10X SMALL BETS portfolio.

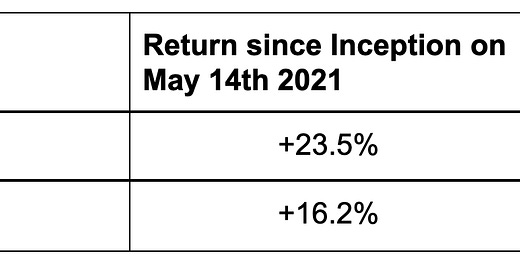

Here is how the 10X POTS are performing at market closure today, Sept 22th 2021

I did a review of each position in the portfolios a few weeks ago:

Here is what I am adding to my 10X FREE CAPITAL POT and why. I’m using the closing price of today as a reference.

SNAPCHAT ($SNAP)

Already a 100BN+ Market Cap company, I like it because they have managed to turn the company to profitability over the last two years in a decisive way. Sales are accelerating and $SNAP is improving across all key metrics. Then I like the idea that the company could potentially reach billions of users as today less than 300M users actively use the app, leaving a lot of room for expansion. They are innovating in the space of the use of mobile for videos, images and Augmented Reality (AR). People using the app are mostly under 35 years old. If they keep innovating and expanding internationally they will be a much bigger company in a few years. Link to the company presentation: https://investor.snap.com/overview/default.aspx

ShockWave Medical, Inc. ($SWAV)

A 7BN+ Market Cap company, I like it because they introduced a new technology to treat diseases that are very common (ex. Heart disease). After some years expanding, now they are winning big in the market as incredible sales acceleration shows. The company is now profitable and also in this case all key metrics are trending in the right direction. This type of technology takes time to gain market share in the medical sector that usually moves slowly in adopting new technologies. I interpret the strong sales and profitability momentum as a sign of a tipping point that can help the company accelerate its growth trajectory over the next 5 years.

Link to the company presentation: https://ir.shockwavemedical.com/news-events/presentations

Kulicke and Soffa Industries, Inc. ($KLIC)

A 4BN+ Market Cap company serving the semiconductor and LED industry. All key numbers trending in the right direction, a sign of great execution and market tailwinds. I like the fact that it is based in Singapore, properly serving the asian market. The company has been around since 1951. I like the fact that they have been heavily investing to expand the company which tells me about how confident they are about future opportunities.

Link to the company presentation: https://investor.kns.com/

Here is what the Key numbers for these companies look like:

As you can see, all of them have a projected 3Y sales forecasted at a minimum of 33% per year. Last Trailing Twelve Months (TTM) sales vs previous quarter have accelerated to at least 19%, Return on Assets (profitability) accelerating at least 166% versus previous year. These are signs of very healthy and robust businesses that are executing very well, expanding and growing fast.

Below is the link to my FREE 10X POT portfolio, now updated.

[Link]

I’ll be adding 4 names to my 10X SMALL BETS POT portfolio very shortly. Stay tuned!

-

Important: this is not investment advice. Consult a licensed financial advisor before making any investment decision.