Very quick update this week—written after spending five hours watching Jannik Sinner lose to Carlos Alcaraz. What an epic match!

Back to the markets

Macro

No material news. Liquidity and credit remain OK, my main leading indicators for equities.

The new CPI print arrives this week and is expected to come in slightly worse than the prior reading. The market already anticipates this.

Index

The S&P 500 added about 1.5 % last week.

All key moving averages slope upward, confirming an up-trend.

The weekly MACD just crossed into positive territory above the zero line.

Portfolios

10X Momentum Portfolio

My pending ALVO 0.00%↑ order was triggered last week; here’s what I’m doing now:

IESC: place a buy-stop for 7 shares at $280. If triggered, set a stop loss at $219. This tops up the position to a full size; the initial lot is already up +14 %.

MGNI: place a buy-stop for 230 shares at $17.70 with a stop loss at $14.70. Full position.

AMTM: place a buy-stop for 95 shares at $22.50 with a stop loss at $18.90. Half-size position.

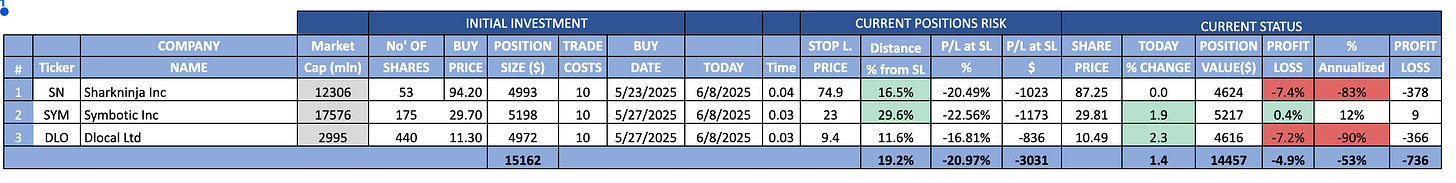

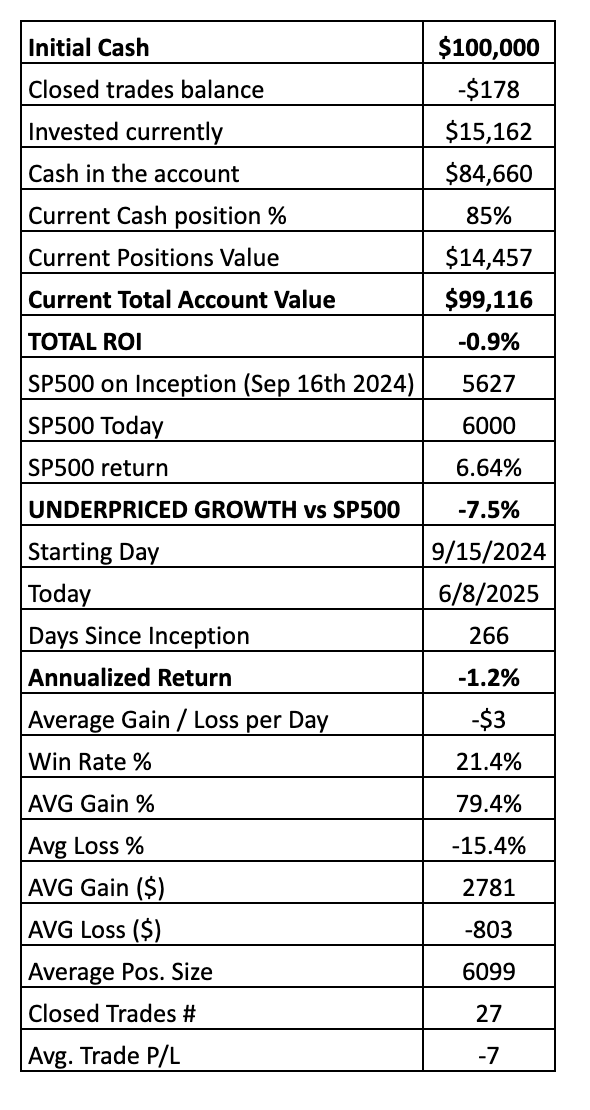

10X Underpriced Growth Portfolio

Last week’s order did not trigger. New instructions:

HOOD: place a buy-stop for 67 shares at $75 with a stop loss at $55. Half-size position.

ZETA: place a buy-stop for 360 shares at $13.95 with a stop loss at $11.90. Half-size position.

All my other portfolios had a solid week. Paid subscribers can access every live portfolio link in one place here.

Wrap-up

That’s it for this week! If you found this useful, please like or share.

Important: This content is not investment advice. Consult a licensed financial advisor before making any investment decisions.