If I had a crystal ball, I'd like to buy stocks at the bottom and sell at the top. But nobody can do that consistently over time.

I have been reading stories about an imminent crash since June... only to see the market print new highs for many more weeks.

I have a list of great stocks I want to add to my POTS but I haven't yet. Why?

Here is my reasoning in a nutshell:

1. I buy stocks for the very long term... and I believe the best strategy is to buy them consistently over time (once a month, a quarter, etc.). This is what is called "dollar-cost averaging"

2. I believe we are in a secular bull market and the 20' will be a decade of strong economic growth, especially as we are getting out of the pandemic

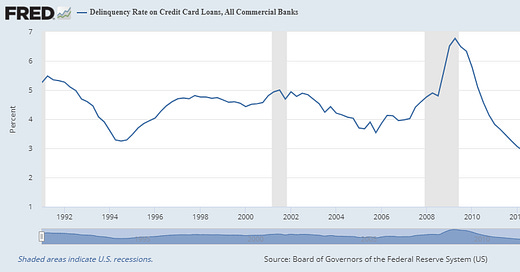

3. I believe that bear markets (set aside wars, pandemics and the like) are preceded by credit crunches: getting a loan or refinancing debt becomes more difficult and this becomes the first signs of a recession and bear market

4. the data show us that the market is fairly valued or slightly …

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.