Here is my weekly quick take on the markets.

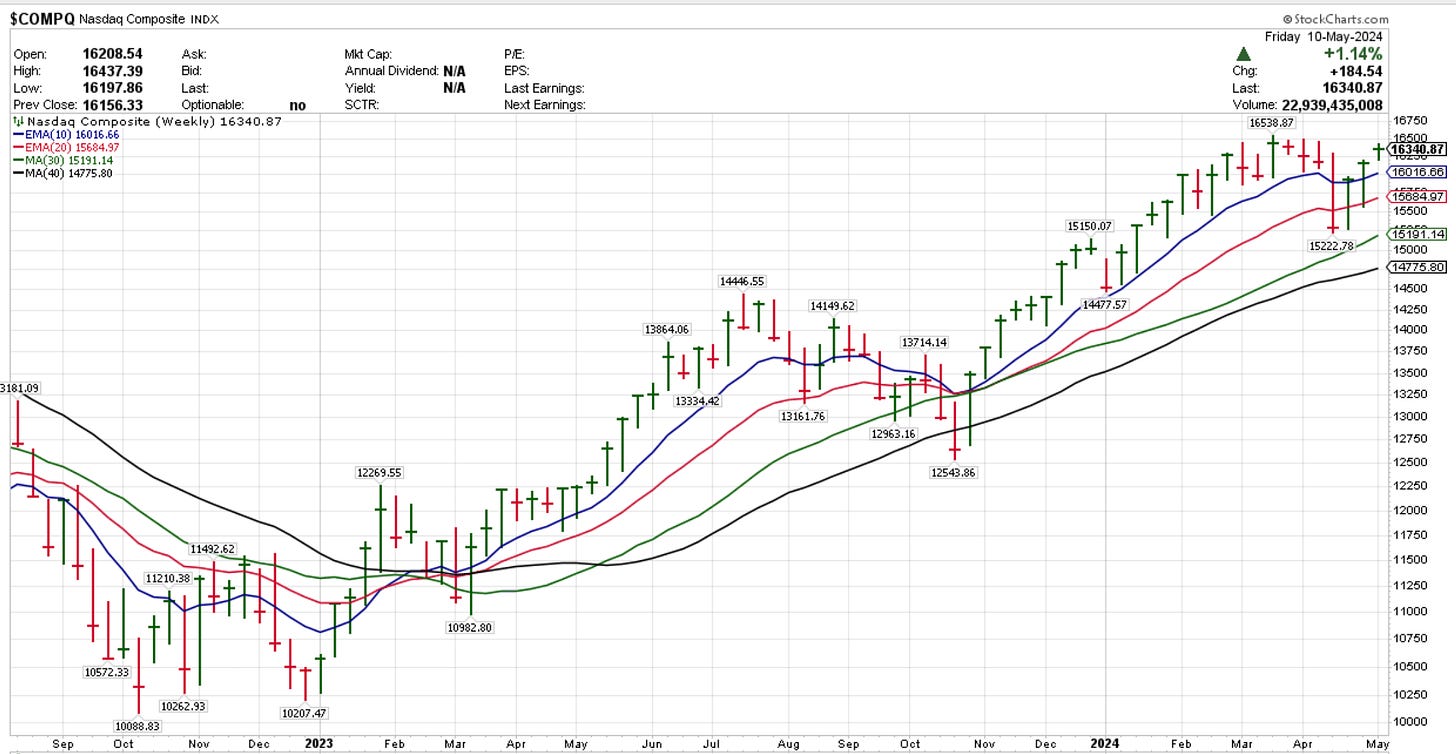

The Nasdaq moved 1.14% higher on below-average volume so it is in “waiting mode” as this week we’ll get to know what the inflation registered in April, a number we know can move the market a lot right now.

The 10-year treasury yield barely moved at +0.09% for the week, again, a sign of “waiting mode”.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.