Important: This is not investment advice. Consult a licensed financial advisor before making any investment decision.

-

MACRO UPDATE

Markets remain volatile as tariff uncertainty and spending cuts fuel recession fears. I’m watching for monetary easing, but I don’t see it yet.

On the bright side, financial conditions remain healthy:

Inflation is at 2.8%, expected to drop to 2.5% by March 2025.

Oil prices are low.

GDP nowcast stands at 2.7% for Q1 and 2.6% for Q2.

My take: The macro backdrop remains supportive for equities in the mid-term, but the market needs a catalyst—potential triggers include:

Resolution of tariff disputes

Possible tax cuts from a Trump administration

An end to the war

MARKET & INDEXES

The NASDAQ fell -2.4% this week and is now below its 40-week moving average, entering an early Stage 4 (Stan Weinstein’s methodology).

I expect a short-term bounce and don’t see a recession yet, but with key moving averages pointing downward, I’m not buying just yet.

PORTFOLIOS

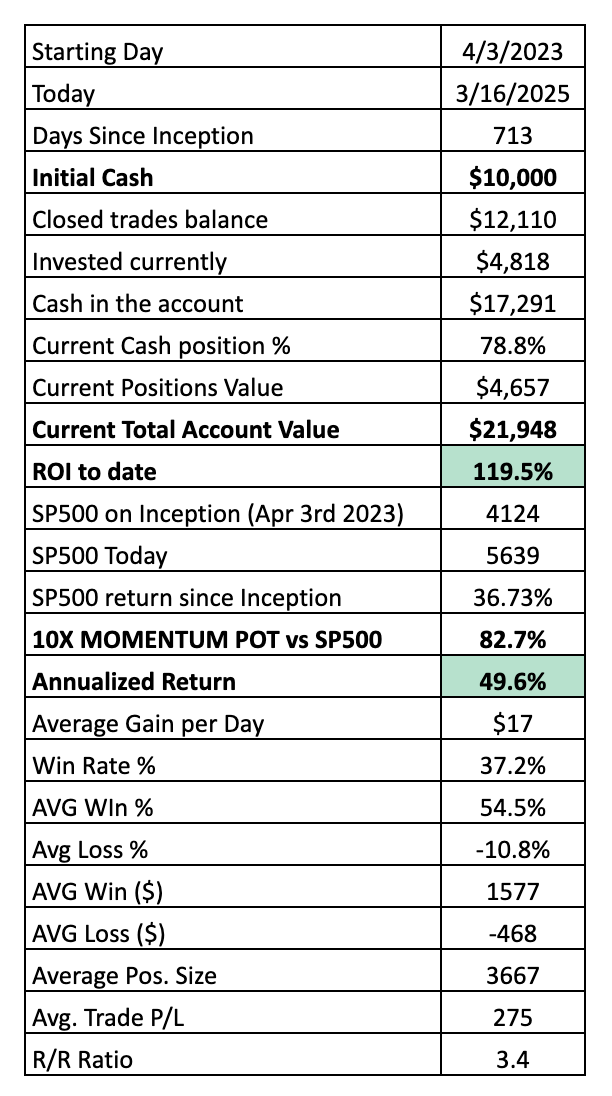

10X MOMENTUM PORTFOLIO

I’m only holding PDD—no new buys this week.

10X UNDERPRICED GROWTH PORTFOLIO

Fully in cash—waiting for better conditions.

10X LONG-TERM PORTFOLIO

This is my long-term portfolio, reviewed twice a year. Market corrections offer opportunities to add to positions or open new ones.

So far, the portfolio is underperforming the S&P 500 by 9% but has still returned 6% annualized since May 2021.

New additions to my 10X LONG-TERM PORTFOLIO: AMD, NXT, META

I’m adding Advanced Micro Devices (AMD), Nextracker (NXT), and Meta Platforms (META) to my 10X Long-Term Portfolio, based on strong fundamentals and macro tailwinds.

1. Advanced Micro Devices (AMD)

AMD specializes in high-performance CPUs and GPUs for gaming, AI, and data centers.

Fundamentals: 19% revenue growth, 26% ROA, 13% asset growth, 21x P/E

Macro Drivers:

AI & Machine Learning: Demand for high-performance chips

Cloud & Data Centers: Expanding enterprise computing needs

Gaming & Esports: Strong GPU market

2. Nextracker (NXT)

Nextracker produces solar tracking solutions for utility-scale projects.

Fundamentals: 21% revenue growth, 84% ROA, 15% asset growth, 7x P/E

Macro Drivers:

Renewable Energy Growth: Increased solar investments

Energy Storage & Grid Upgrades: Smarter, more efficient energy solutions

Government Support: Subsidies and clean energy incentives

3. Meta Platforms (META)

Meta dominates digital advertising and is expanding into AI & the metaverse.

Fundamentals: 22% revenue growth, 27% ROA, 23% asset growth, 18x P/E

Macro Drivers:

Metaverse & AR/VR: Continued investment in virtual worlds

AI-Powered Ads: Smarter ad targeting for revenue growth

Digital Commerce & Content: Social commerce expansion

Next → Subscribers-Only Content

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.