Macro Overview:

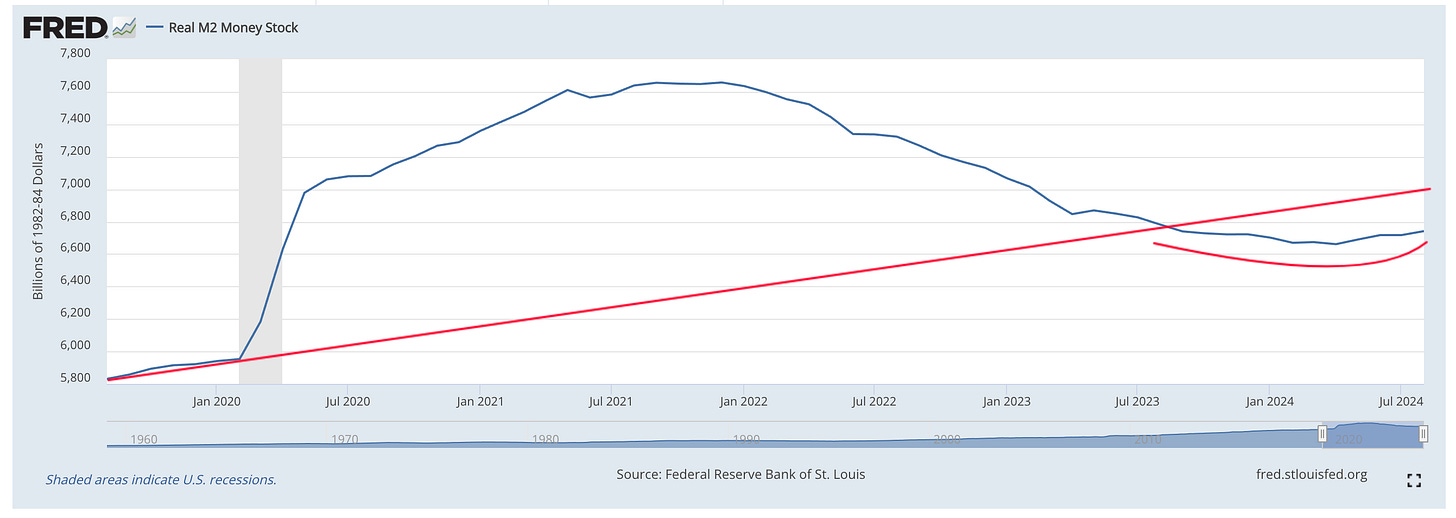

M2 data for August 2024 has been released, confirming a shift in monetary policy. The restrictive phase ended in April, and real M2 is now trending upward, which is a positive sign for the economy.

Globally, the most significant development was China’s aggressive fiscal and monetary stimulus. The Chinese stock market responded well, closing the week with gains of around 20% on huge volume.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.