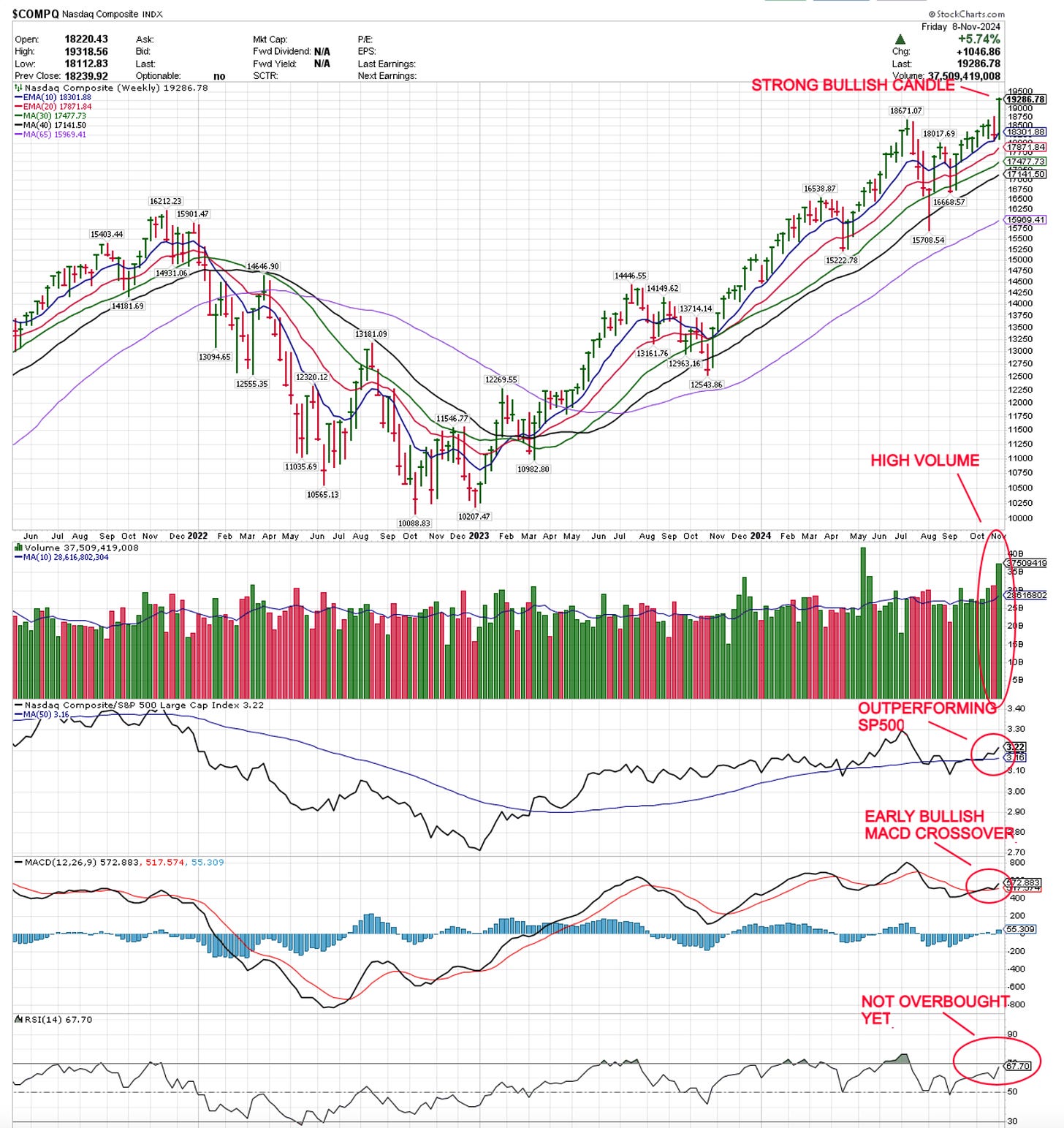

Let’s start with the NASDAQ weekly chart. The index had a very strong week, closing up +5.7%:

All key moving averages are pointing upward.

Strong bullish candle with high volume.

The NASDAQ is outperforming the S&P 500.

Positive momentum, with a recent bullish crossover in the MACD.

We are not yet in an overbought zone.

From a macro perspective, we have:

A clear winner of the elections, reducing uncertainty.

A rate cut from the Fed, with hints of more cuts in the future.

GDP growth forecast of 2% for Q4.

An inflation rate under control at 2.6%, which is not concerning for now.

My Take

The backdrop for stocks remains favorable.

Valuations in some sectors (e.g., AI and tech) could become an issue as they may start to look unsustainable.

The market itself could become overextended, making corrections an opportunity.

Managing risk is key to preserving gains as much as possible.

It’s time to stay optimistic until proven otherwise—just remember not to become complacent.

PORTFOLIOS

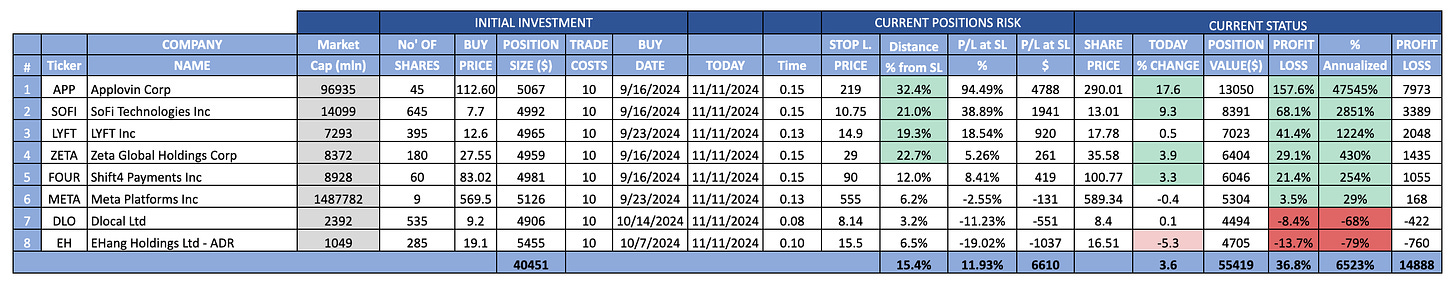

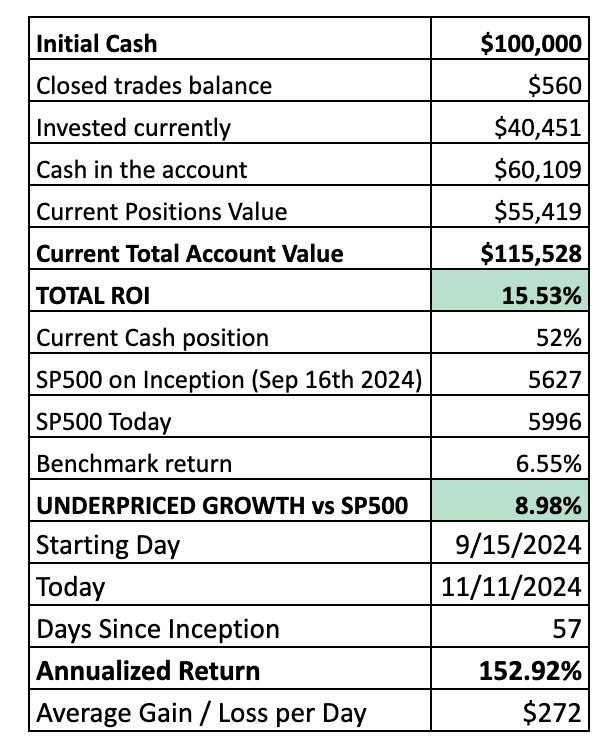

10X Underpriced Growth Portfolio

I currently have 8 positions, and looking back, I regret not buying full positions in APP, SOFI, and LYFT. Since I bought them, they've gone up 158%, 68%, and 41%, respectively. The portfolio is outperforming the S&P 500 by 9% since inception and is delivering an annualized return of 153%—even though I’m holding 50% in cash!

What I'm doing this week:

I updated all my stop-loss levels.

I'm investing $5,000 each in FOUR, LYFT, SOFI, and ZETA to bring each of these to a full position.

I plan to buy 170 shares of HIPO 0.00%↑, a property and casualty insurance company if it hits $28.96. This company is growing quickly (projected revenue growth of 57%) and looks undervalued based on my analysis.

I'm also starting a position in GCT 0.00%↑ (GigaCloud Technology) by buying 178 shares if it reaches $28.10. GCT offers B2B e-commerce solutions for large parcel goods in the U.S. and internationally.

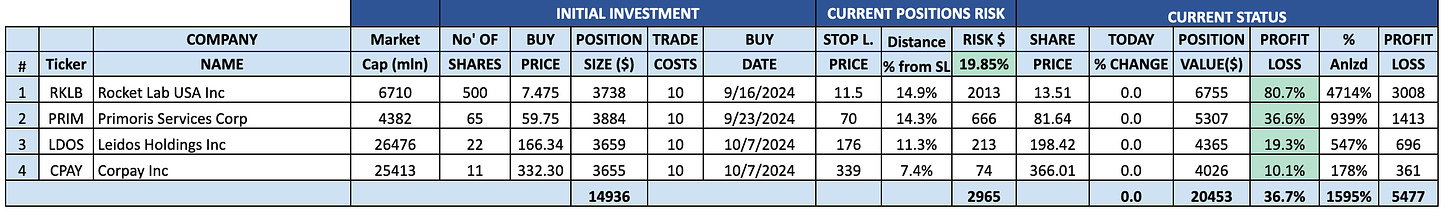

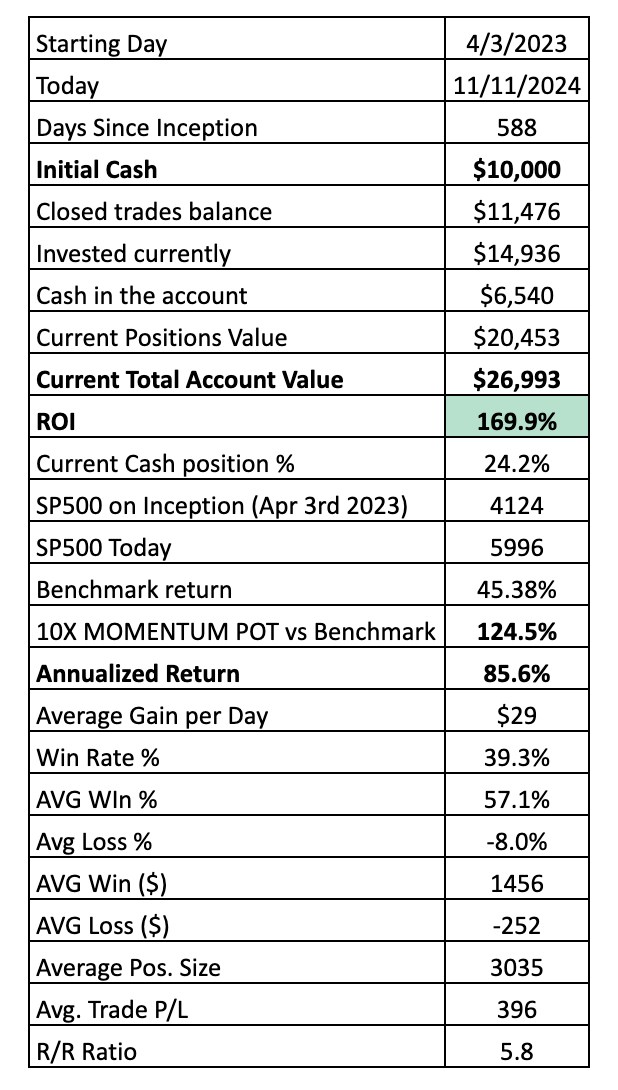

10X Momentum Portfolio

I recently exited my CMPO position here with a 74% gain. Going forward, I'll focus on managing just one momentum portfolio. Here’s how it currently looks:

All positions are in positive territory, with RocketLab up 81% (annualized at 4714%). Below is the portfolio’s scorecard:

An annualized return of 86%, outperforming the benchmark by 3.7 times. No complaints here!

What I'm doing this week:

Updated my stop-loss levels as shown above.

Buying 355 shares of ACAD 0.00%↑ it touches $17.97. ACADIA Pharmaceuticals Inc., a biopharmaceutical company that focuses on the development and commercialization innovative medicines that address unmet medical needs in central nervous system (CNS) disorders and rare diseases in the United States. Acadia is growing above 47% YoY and expected to grow at +25% over the next two years.

That’s all for the week. Let’s see what this November will bring us!

-

Important: This is not investment advice. Consult a licensed financial advisor before making any investment decision.