MACRO

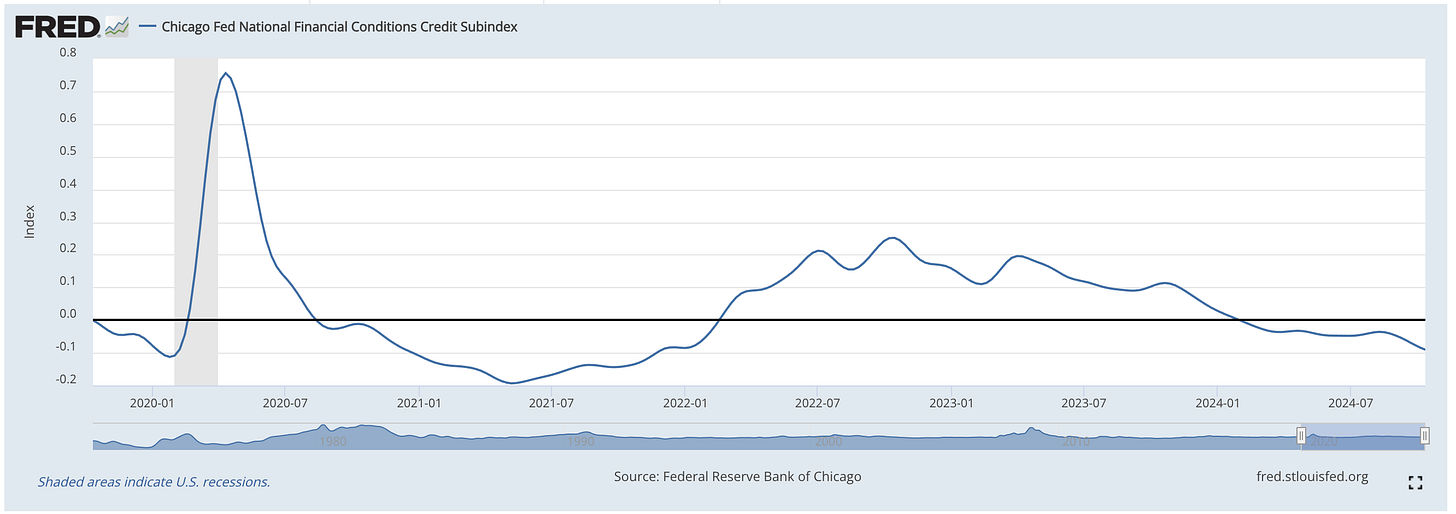

Financial conditions keep improving. GDP for Q3 is expected at 3% and at 2.6% for Q4 2024.

Liquidity is improving (M2) so I don’t see crashes in the near term because of economic conditions.

Elections are the main variable on the table.

INDEXES

The Nasdaq closed at all-time highs with the weekly MACD crossing the signal line, indicating positive momentum.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.