Momentum, Growth, and 2025: My Investing Playbook and Market Outlook

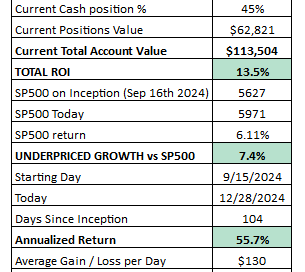

December 29th, 2024 - Update

Investing in Innovation: My Strategy, Portfolios, and Market Outlook

Every so often, it’s good to take a step back and summarize my investing philosophy and the strategies I’m implementing to navigate the markets. Whether you’re a seasoned reader or new to this blog, this post will give you a clear picture of what I’m trying to achieve, how I’m doing it, and where I see the markets heading as we move into 2025.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.