Markets on Edge: Inflation Eases, Trump Policies & Meme Coins Shake Things Up

January 19, 2025 Update

Important: This is not investment advice. Please consult a licensed financial advisor before making any investment decisions.

Disclosure: The content has been reviewed using artificial intelligence to enhance readability and ensure grammatical accuracy.

—

Exciting Times Ahead!

Last week brought some relief as inflation numbers came in slightly better than expected. The 10-year yield dropped to 4.6% from 4.8%, signaling stability, while the NY Fed's GDP nowcast for Q1 2025 stands at a healthy 3%.

Key Market Factors to Watch:

Growth vs. Inflation: If the economy heats up too much, the Fed might consider rate hikes, which could impact high-growth stocks. However, it's a strong setup for companies with accelerating earnings.

Trump’s Inauguration: All eyes are on policy shifts in finance, energy, tariffs, and debt reduction.

Javier Milei’s Economic Revolution: Argentina is seeing results in deficit control and economic revival, influencing global discussions, even in the crypto space.

Trump Meme Coin?! A wild move that could shake up markets and crypto sentiment.

Market and Portfolio Updates:

Market Performance

S&P 500 Equal Weight (RSP): Up +3.92%, showing strong participation in the rally.

NASDAQ: Closed +2.45% for the week, maintaining an upward trend.

10X Momentum Portfolio

Performance: 79% annualized, 183% since inception.

Notable Move: Stop-loss triggered for MGNI (-13.7%), but the strategy remains intact.

Stop Loss levels: updated.

New Buys:

CRDO – Stop Buy order at $82, Stop-Loss at $64.9

SMTC – Stop Buy order at $75.75, Stop-Loss at $61.9

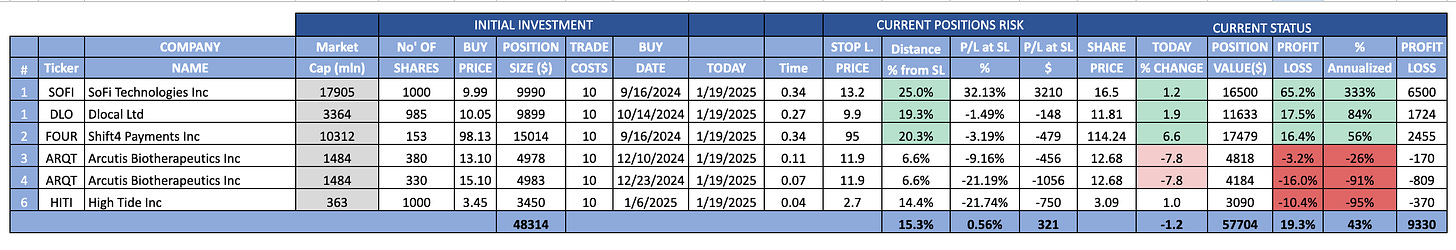

10X Underpriced Growth Portfolio

Performance: +12% since inception, 38% annualized, beating the S&P 500 by 5%.

Key Loss: AEHR hit stop-loss (-25% to -30%) due to weak revenue guidance.

Stop Loss levels: updated.

New Buys:

HOOD – Buy at $49.3, Stop-Loss at $37.9

ASUR – Buy at $12.39, Stop-Loss at $9.45

10X Best of ARKK Portfolio

Performance: +40% since October 2024 (+244% annualized), outperforming ARKK ETF by 14% points.

Strategy: Sold 8 stocks, added 7 new stocks (details for premium members).

Next Review: Mid-April 2025.

Final Thoughts:

The market looks bullish in the mid-term, but risks remain: inflation, tariffs, geopolitics, or a Fed shift. I'm prepared for both scenarios—either a market boom or a volatile ride.

Let’s see what Trump’s first days bring. Stay sharp!

Members can access the 10X BEST OF ARKK PORTFOLIO below

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.