Market Update: SP500 Strengthens, Inflation Eases, and Momentum Portfolios Surge.

June 18 Update

Important: this is not investment advice. Consult a licensed financial advisor before making any investment decision.

-

Here is my quick update for the week.

The SP500 keeps its good and improving look, above the 4300 resistance level.

Most of the sectors were positive for the week and it is worth mentioning that Industrials had a strong week:

Industrials Equal Weight Index:

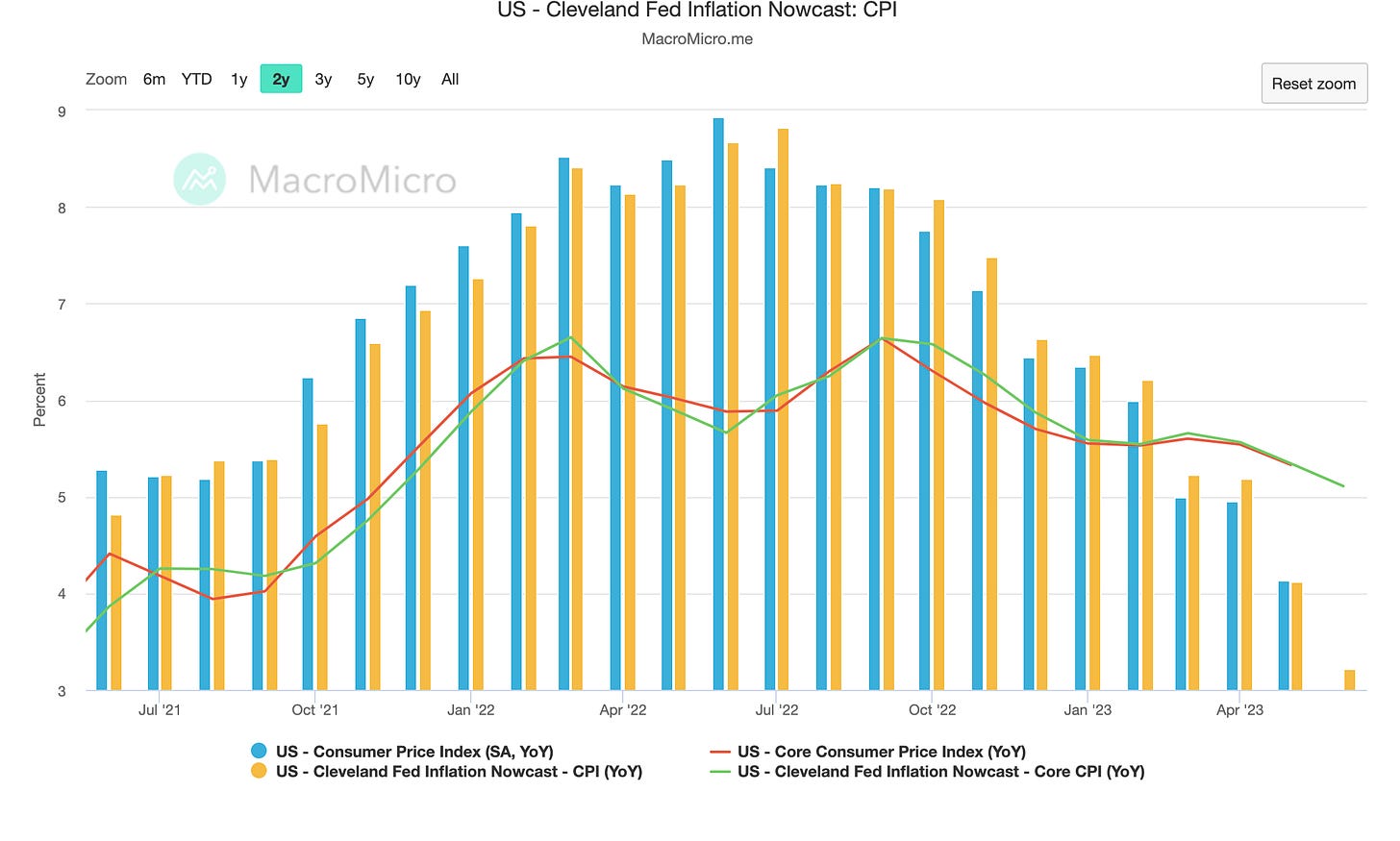

The week was characterized by a better-than-expected CPI Inflation reading for May. The next reading will see the YoY CPI reading touch 3.2% or so. See below how quickly the CPI numbers have been trending down:

Last, I want to highlight how overall world equities performed well last week and the look now has improved. See the “All World excluding the US” index below and notice how is trending up:

In a nutshell:

If inflation continues to trend down, we may approach the Federal Reserve's 2% target within the next few months.

Lower oil prices and improvements in the supply chain continue to contribute to the overall decrease in prices.

Inflation expectations have been consistently declining thus far.

Given these circumstances, it is highly likely that the Federal Reserve will no longer raise interest rates and may even start to ease its quantitative tightening measures.

It's important to note that we are still operating under the Federal Reserve's Quantitative Tightening regime, which calls for careful attention and caution.

Unless there is negative economic data, it is likely that the market will continue to experience upward momentum.

The increasing participation of cyclicals, including Industrials, alongside the Tech sector's positive performance, indicates a growing optimism in the market.

My POTS (Portfolios)

Both my Momentum Portfolios improved this week. I am almost fully invested when it comes to my MOMENTUM PORTFOLIOS.

10X LARGE CAPS MOMENTUM POT (link to portfolio)

This week I am adding LI 0.00%↑ to the POT if it goes above $34.41 and, in case the order is executed, my first Stop Loss will be placed at $27.97

Li Auto is a Chinese auto manufacturer that is growing at above 60% YoY with improving profitability and yet undervalued.

It is a calculated risk but if China keeps recovering the stock may have a substantial upside.

Have a look at their products here: https://www.lixiang.com/

10X SMALL CAPS MOMENTUM POT

Another good week for the POT which has 8 positions and an average unrealized gain of +40%

I am beating the SP500 by 50% or 5% absolute points (15% vs 10%)

Below is the full picture if you are a supporter.

That’s all for the week!

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.