Last week, the Nasdaq closed at -2.5%.

The S&P 500 finished at -1.6%.

MACRO

Inflation nowcasting for February 2025 is at 2.82%, showing improvement.

Oil prices keep trending lower, which should help contain inflation.

10-year Treasury yield is trending down, signaling modest inflation concerns.

GDP nowcasting for Q1 2025 is at 2.9%, indicating robust growth.

Monetary policy is still somewhat restrictive. M2 money supply is stalling, reflecting the Fed's cautious stance.

Earnings are growing, though there are signs of a slight slowdown.

Credit conditions remain healthy, but corporate borrowing is still subdued.

A ceasefire in Ukraine would be great news if it happens.

Valuations are high but not at bubble levels.

Spending cuts under the DOGE initiative could dampen short-term spending. Tax cuts might offset some of that.

Overall, the mid-term outlook seems positive for stocks, unless credit conditions worsen. So far, they remain stable.

INDEX

The Nasdaq has moved sideways since late November 2024.

On the weekly chart, a descending triangle is visible.

Despite a broadly bullish picture, the 10-week SMA is now trending down.

This breaks my rule for new positions. From my first eBook:

1️⃣ Market Risk: Only Invest in an Uptrend

Condition 1: The S&P 500 and Nasdaq must be above their 200-day moving average.

Condition 2: The 50-day (or 10-week) moving average must be sloping upward.

Since Condition 2 isn’t met, I’m not buying.

Market corrections are normal, so I’ll wait for a better setup.

PORTFOLIOS

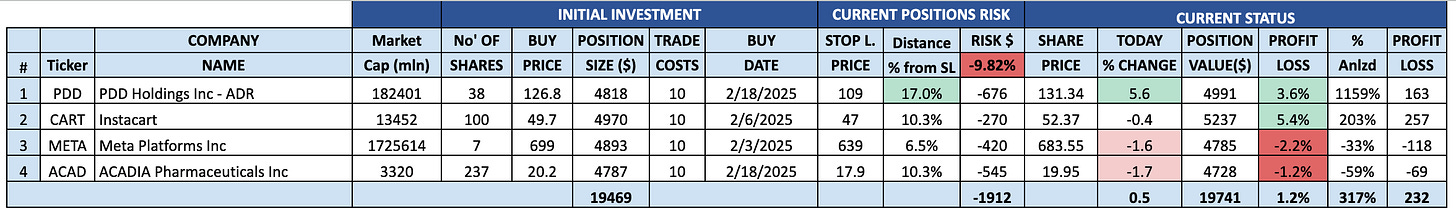

10X MOMENTUM PORTFOLIO

📌 Start Date: April 2023 – Initial Capital: $10K

📌 Focus: High-growth, high-quality stocks

📌 Strategy: Ride bullish trends over weeks/months

📌 Risk Management: Tighter stop losses (~15%)

📌 ROI to Date: +140% (59% annualized)

My buy-stop orders for ACAD and PDD were triggered.

I now have four open positions. Stop-loss levels have been updated.

I’m not buying anything this week.

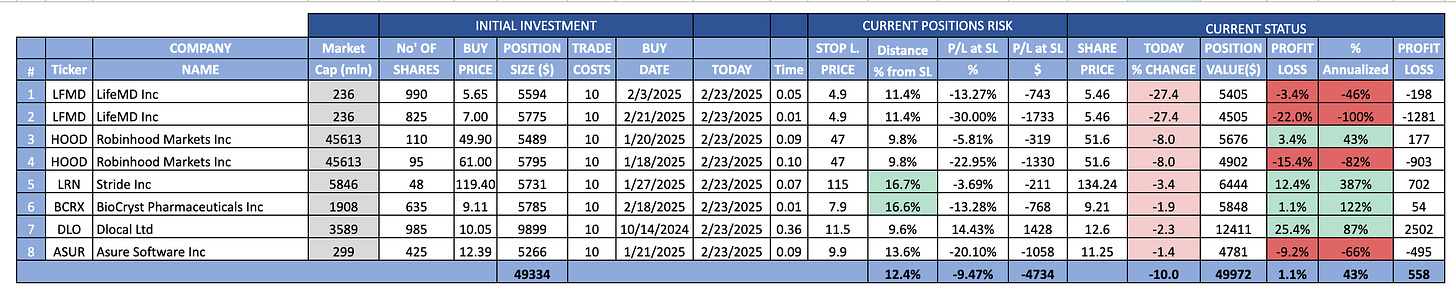

10X UNDERPRICED GROWTH PORTFOLIO

📌 Start Date: Sept 15, 2024 – Initial Capital: $100K

📌 Focus: High-growth, undervalued companies

📌 Strategy: Up to 10 positions with wide stop losses (25–30%)

📌 ROI to Date: +7% (17% annualized)

📌 Goal: Explosive growth in strong markets

Last week’s moves:

Stopped out of FOUR for a 9% gain.

HOOD and LFMD orders were triggered, but I bought them on a dip that went even lower. This was a learning point.

Updated all stop-loss levels.

UNDERPRICED GROWTH MONTHLY EBOOK SERIES PORTFOLIO

For paid supporters, more details are available beyond the paywall below.

That’s it for this week!

If you enjoy my content, please hit Like.

⚠️ Disclaimer: This content is for educational purposes only. It is not investment advice. Consult a licensed financial advisor before making decisions.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.