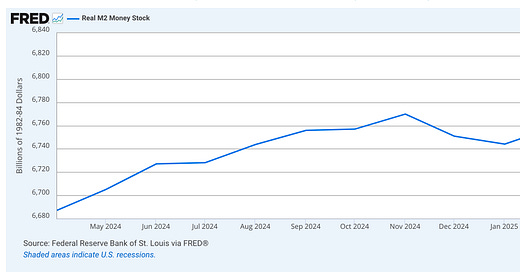

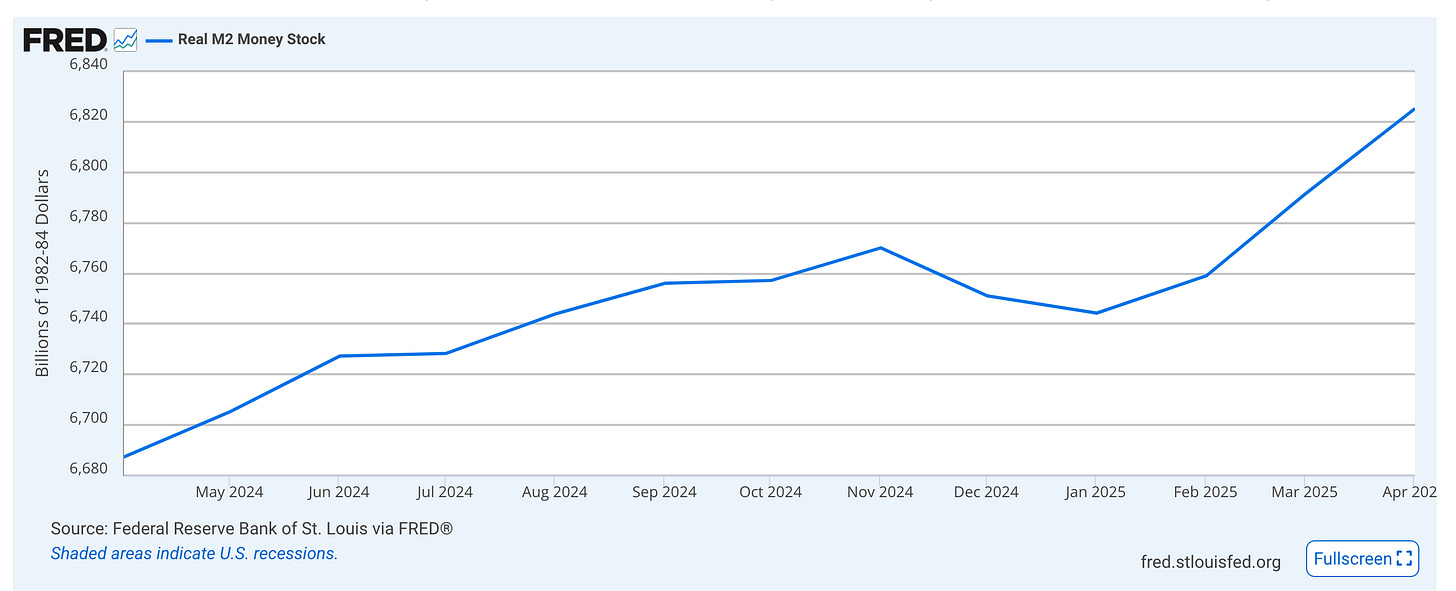

We have new data on the U.S. M2 money supply, and the trend continues to move upward.

Here’s the broader picture:

Over the 12 months ending April 2025, M2 grew by about 2%. During the same period, real GDP grew 2.1%, and inflation ran at 2.4%.

In short, the Federal Reserve has kept liquidity just high enough to support growth and keep inflation under control. It's a tough balance, but so far, they’re managing it well.

M2 is not growing rapidly—this isn't a QE-style environment—but it's rising steadily. Meanwhile, inflation is heading toward the 2% target. All of this is happening while we deal with the unpredictable fallout from the current wave of tariffs.

My view: the Fed is getting it right. They’re unlikely to cut rates now, even though that may happen later this year.

It’s encouraging to see the 10-year Treasury yield falling to 4.4%. That’s a positive sign. Oil prices staying below $70 per barrel also help reduce inflation pressures.

GDP shrank by 0.2% in Q1, mainly due to a spike in imports ahead of new tariffs. But forecasts for Q2 2025 are between 2.4% and 3%. That points to a strong economy that doesn’t need rate cuts yet.

In my opinion, the backdrop for stocks and economic growth remains solid. The ongoing tech revolution, especially in AI and robotics, is a key driver.

The main risks come from geopolitics. Tensions are rising in Ukraine, Taiwan, and the Middle East. Also, economic policy under the Trump administration—especially on tariffs—remains unpredictable.

But there’s always something to worry about. Despite the noise, the economic fundamentals look positive.

Indexes

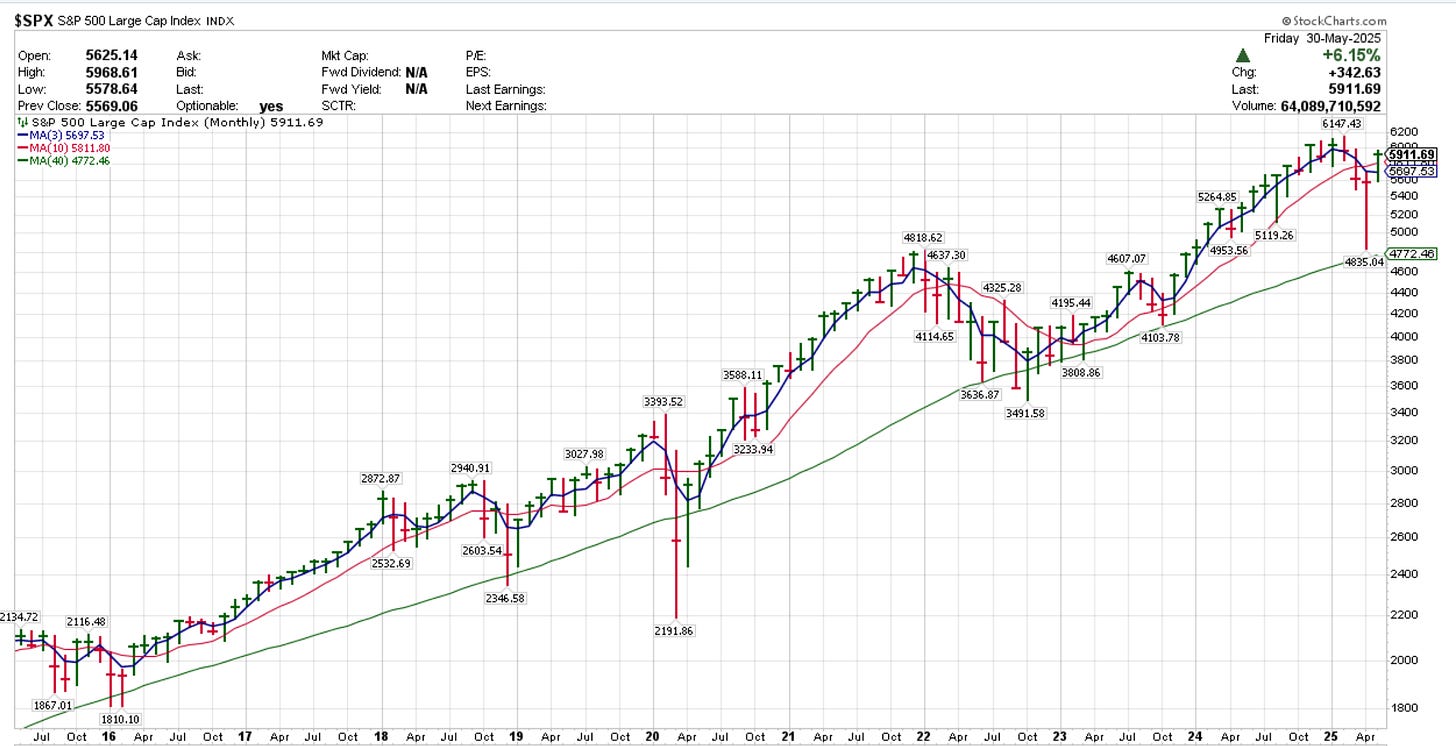

The S&P 500 rose about 6% in May. The monthly chart looks strong, with prices above key moving averages.

The weekly chart also shows building momentum (see below).

PORTFOLIOS

10X PICKS for 2025

My 10 picks are still in the red this year, down 16%, with only CELH and MU showing gains. There are still seven months to go. This is a 12-month 'buy and hold' portfolio, so let’s see what the months ahead bring.

All companies reported positive revenue surprises except GTLS, CELH, and FOUR. All companies beat EPS estimates except FSLR and CELH. All companies maintain forward revenue growth above 10%, except RPD and AEHR.

10X MOMENTUM PORTFOLIO

Last week my FIX 0.00%↑ order was executed. Below is what the portfolio looks like today. Stop Loss levels updated.

And current performance scorecard since inception. After more than 2 years, portfolio is up +114% (+42% annualized).

Here is what I am doing this week.

I’m placing a BUY STOP order for 178 shares of $ALVO at $11.77. As usual, the order will remain open for the entire week. If triggered, I’ll place a stop loss at $10.1

Below is the weekly chart of ALVO:

10X UNDERPRICED GROWTH PORTFOLIO

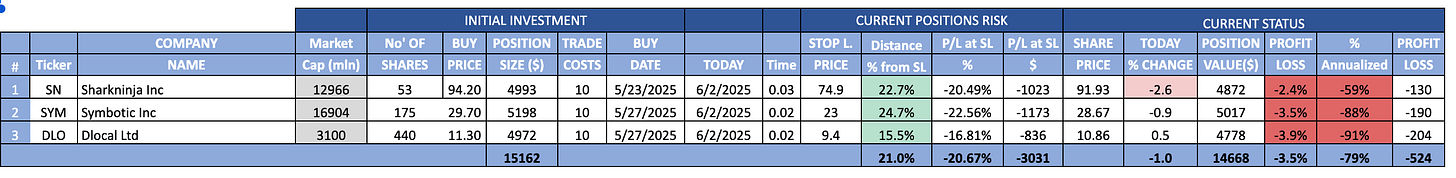

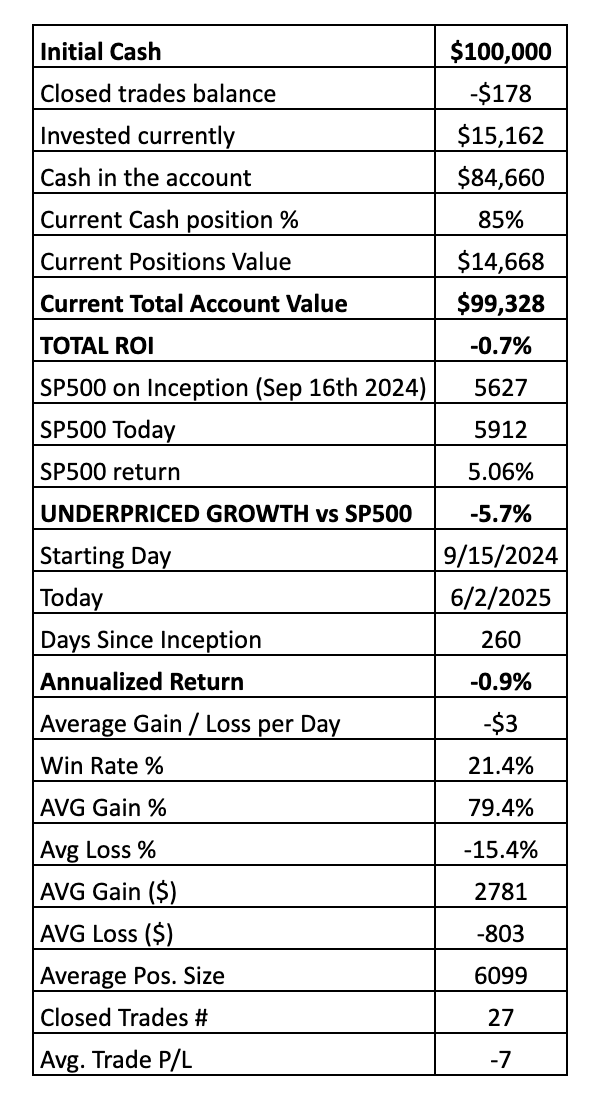

Last week my SYM 0.00%↑ and DLO 0.00%↑ orders were executed. Below is what the Portfolio looks like today:

And current performance scorecard since inception:

Here is what I am doing this week.

I’m placing a BUY STOP order for 50 shares of $FOUR at $98. As usual, the order will remain open for the entire week. If triggered, I’ll place a stop loss at $79.

Below is the current weekly chart of $FOUR:

That’s it for this week!

If you enjoyed the content, please like or share this post. Thanks for reading!

Important:

This is not investment advice. Please consult a licensed financial advisor before making any investment decisions.