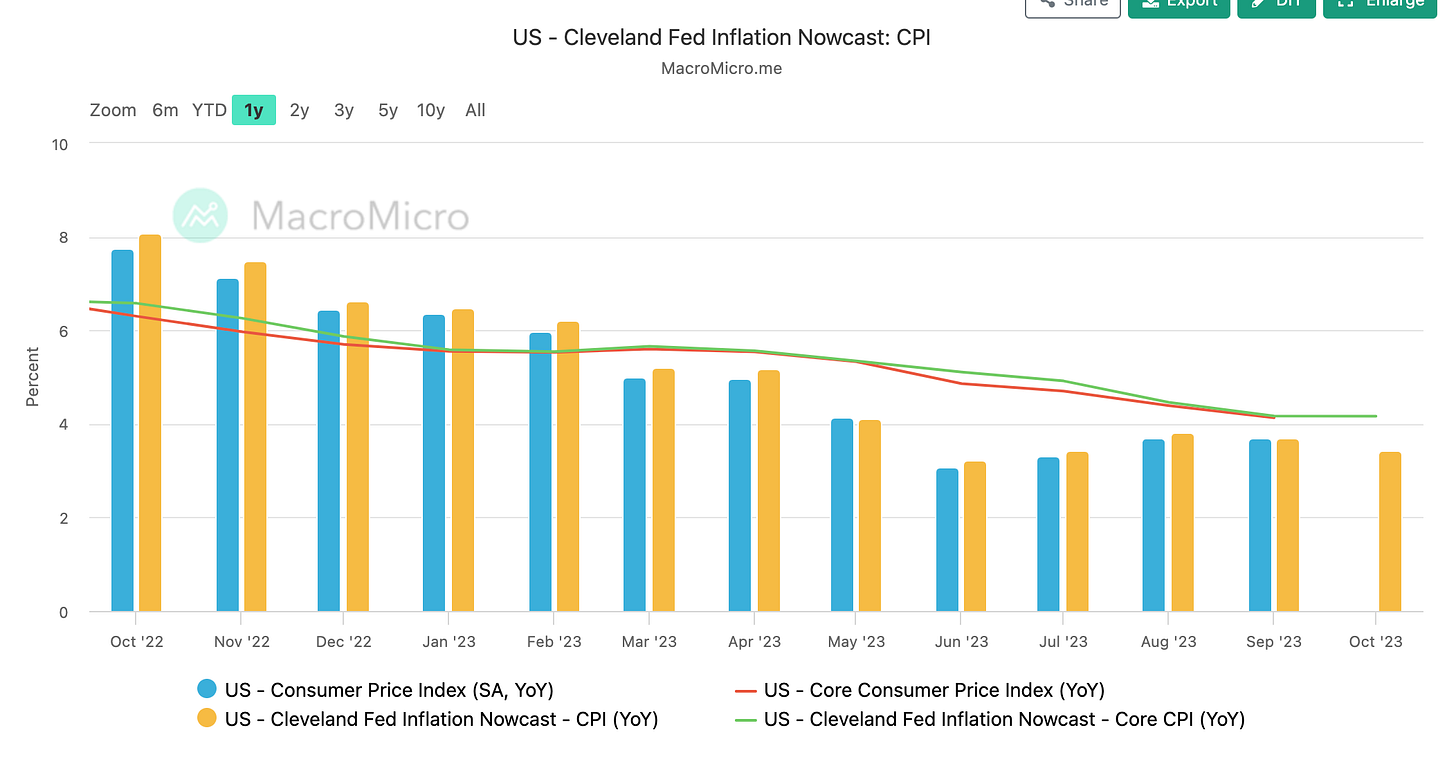

Last week, it was time for the inflation index, and the reading came in at 3.7% YoY, which was as expected. However, the concern is that this number remains the same as the previous month and is higher than the 3.1% reading we had in June.

The inflation trend is down, yet the market fears that it will take too long before we go below 3%. Is the “stickiness” that matters.

The 10-year treasury yield decreased during the week, and it's crucial for stocks that it continues to stabilize or trend downward. This marks a beginning, and I'll watch closely to see if a sustained trend develops in the future.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.