Macro

A new war has started in the Middle East. This is tragic and adds market risk. Headlines will likely steer prices for now.

Inflation came in a bit lower than expected. Tariff effects are still ahead, and oil could rise if the conflict drags on. The Fed will likely wait for clearer data before cutting rates.

The 10-year Treasury yield ticked up to 4.45 %. Watch it closely.

Tariffs already showed how fast shocks can hit markets. We may see similar swings again.

Portfolios

No new buys this week. I want more clarity on geopolitics.

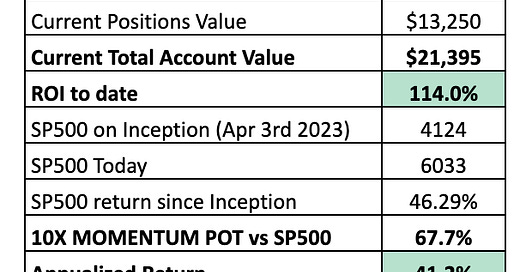

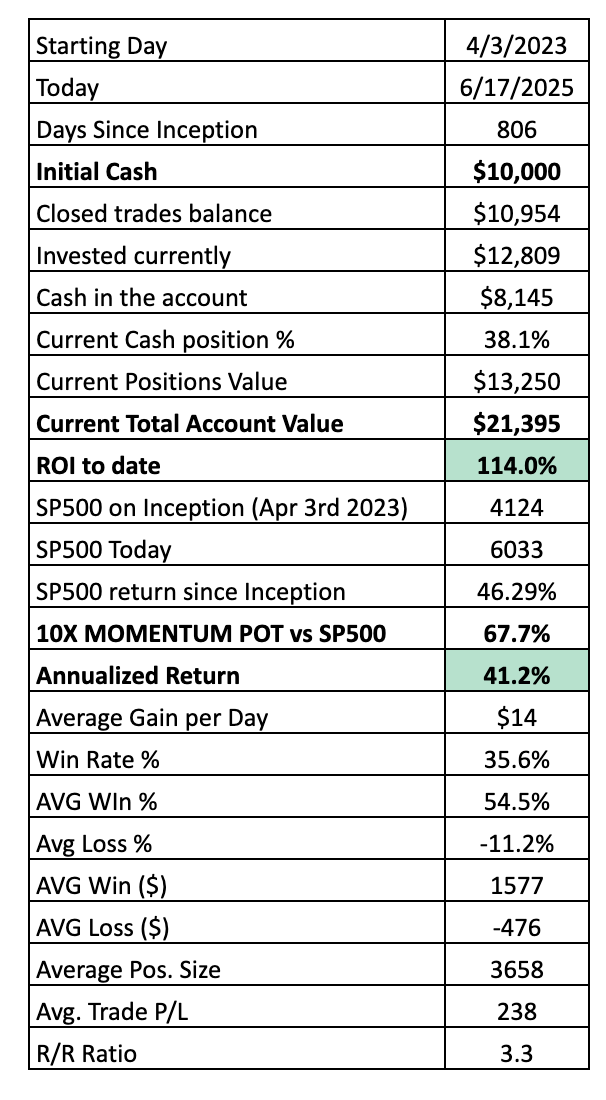

10X Momentum Portfolio

Buy-stops for IESC, MGNI, and AMTM filled last week.

The stop on ALVO hit; I closed the trade for a -14.7 % loss.

I tightened stops on the remaining names.

10X Underpriced Growth Portfolio

Buy-stops for HOOD and ZETA filled.

Stops updated below; no other changes.

That’s it for this week! If you found this useful, please like or share.

Important: This content is not investment advice. Consult a licensed financial advisor before making any investment decisions.