How to invest for the very long term.

A consistent amount ivested every month is the best strategy out there to build wealth.

I recently attended a Global Valuation course as an alumnus of Hult, the Business School where I got my Executive MBA.

My professor, the inspiring and knowledgeable, and passionate Joel Litman told us the following:

"the money you don't need for the next 10 years... should be all invested in stocks!"

Why? Because there is no one single “10 years period” where you would have lost money. Even buying at the highest peak... you'll be higher 10 years later.

Investing in the stock market money you'll not need for the next 10 years... is practically risk-free. So why keeping them in some othe place?

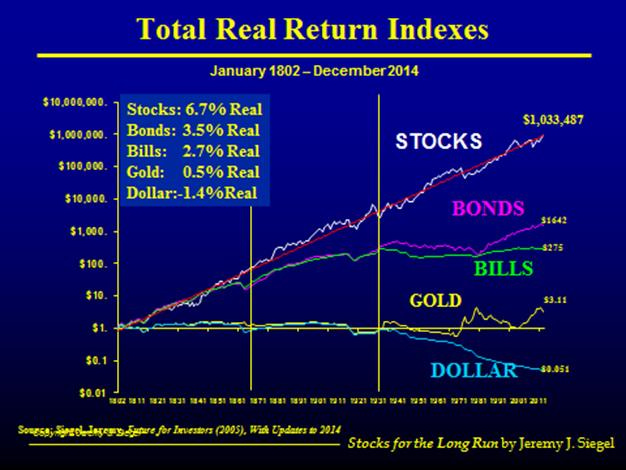

How much a 1802 dollar (1$) would be worth in 2012? Answer: 5 cents! Gold? About $3. Long Treasury bonds? $1642$. Large stocks? Over $1.000.000! See the chart below from Jeremy Siegel:

The average return of the S&P500 since inception has been 10%, or almost 7% adjusted for inflation.

So what is the best way to invest over the long term?

By dollar-cost averaging.You set a fixed amount to invest every mo…

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.