Here my simple process.

I look around trying to spot new brands or companies showing signs of innovation and growth (think the first time you saw a Tesla or tried Netflix for example);

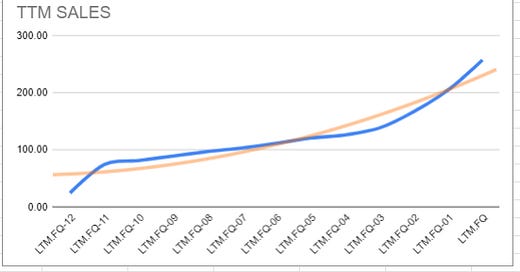

I use screeners on online databases to look for companies growing at 30% yearly: every quarter I track the Trailing Twelve Months (TTM) revenues and compare them with the same number from the previous quarter. I want to see acceleration: is like looking at the yearly sales number, every quarter. See $APPS below as an example:

I look for growing Return on Assets (ROA) and Earnings per share (EPS), but I use a service that provides me with UNIFORM numbers, so public numbers cleaned up from any distortion and that shows the real profitability of a given company, see $APPS for uniform ROA:

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.