If you’ve been following me, you know I treat liquidity and credit availability as the ultimate green/red lights for mid-term investing. Below is every macro note I’ve posted since December 2024:

Dec 1 2024 – “From a monetary perspective, the U.S. environment remains favorable. M2 data suggests a slightly dovish stance, and easier credit is a boon for business.”

Dec 8 2024 – “For now, the data points to a supportive backdrop for stocks.”

Dec 23 2024 – “The mid-term outlook remains favorable for stocks, especially as we enter the Trump administration with solid credit conditions.”

Jan 6 2025 – “I’m watching for inflation to stay under 3 % and for liquidity to remain loose. Overall, I’m bullish on stocks for 2025.”

Jan 26 2025 – “The U.S. economy looks strong, and as long as inflation and credit stay in check, stocks have the wind at their backs.”

Feb 2 2025 – “M2 growth stalled in December. Macro conditions still favor equities, but there’s little room for the market to absorb a sudden Fed tightening.”

Feb 9 2025 – “M2 isn’t growing. A positive inflation surprise could push the Fed toward rate cuts.”

Feb 23 2025 – “Policy is somewhat restrictive and M2 is stalling, yet the mid-term outlook is positive unless credit conditions worsen.”

Mar 2 2025 – “Liquidity in the U.S. is dropping as the Fed fights inflation.”

Mar 30 2025 – “M2 is picking up again, signaling more liquidity.”

Apr 6 2025 – “It isn’t a credit or liquidity crisis. If tariff deals happen soon, this could be a great buying opportunity.”

Apr 13 2025 – “In my view, peak uncertainty may be behind us. If concrete trade agreements emerge, markets may have already bottomed.”

Apr 27 2025 – “M2 continues to tick higher. Growth, inflation, credit, and policy all look acceptable and should keep improving.”

Macro Check-in (Today)

Liquidity: M2 is rising, so credit access isn’t an issue.

Fed stance: The Fed appears to be waiting to see how tariffs affect inflation before turning more dovish.

Tariffs: The “tariff madness” triggered a fear-driven drop and a sharp rebound once the news improved.

Inflation: Currently contained, but I expect a 1- to 3-month blip higher due to tariffs.

GDP: Q2 growth is estimated at 2.3 %.

My view: I remain bullish on stocks over the mid-term.

INDEX

Major indexes are back above their 200-day (40-week) moving averages and above every key shorter-term average. The daily charts show all trendlines pointing higher.

In short, the market is “open for business” again.

PORTFOLIOS

10X BEST OF ARKK

I am impressed with my 10X BEST OF ARKK portfolio experiment. Have a look below.

Launched mid-October 2024, always fully invested, rebalanced quarterly.

Total return: +65 % since inception.

Outperformance: +42 ppts versus ARKK.

Annualized: +144 %.

Next rebalance: mid-July.

2025 10X PICKS PORTFOLIO

Fell roughly 30 % during the tariff panic.

Currently –12.6 % YTD, trailing the S&P 500 by 14 ppts.

Still six-plus months left—plenty of time for a comeback if the grind higher continues.

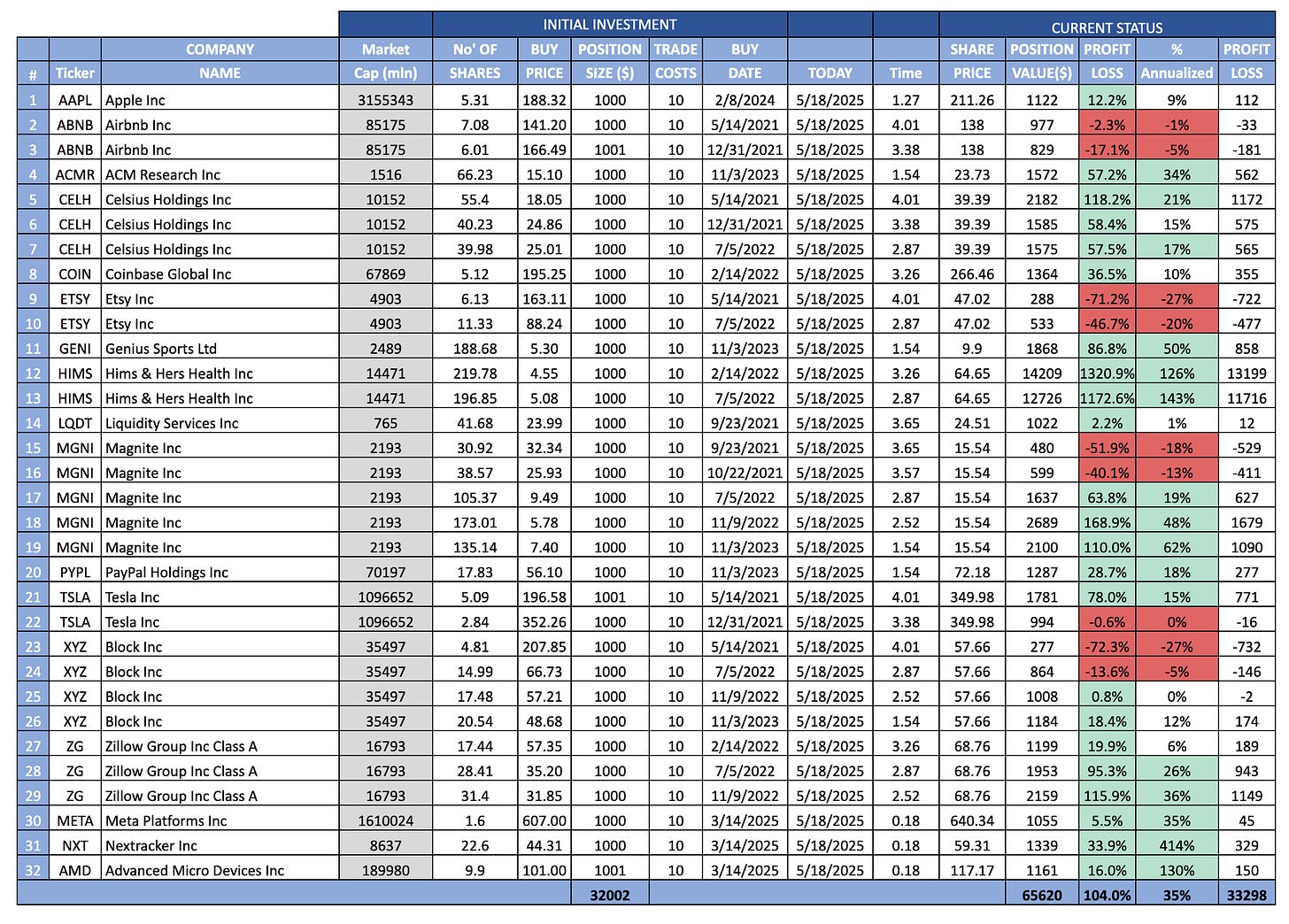

10X LONG TERM PORTFOLIO

I seldom comment on this one, but I just logged my first true 10-bagger: two HIMS positions are up 1320% and 1172%!

Total return: +66.7 % over four years (13.6 % annualized) vs. the S&P’s +42 %.

Adding three foundational AI names this week:

Nvidia (NVDA) – Dominant GPUs and a full-stack AI platform; expanding beyond Big Tech to sovereign AI and emerging clouds.

Micron (MU) – High-performance DRAM and NAND that keep AI workloads moving.

Taiwan Semi (TSM) – The world’s leading foundry; AI demand is rapidly boosting revenue.

10X MOMENTUM PORTFOLIO

Currently 100 % cash. After two years, the portfolio has returned 112.6% in total (42% annualized).

This week, I plan to take action. Over the weekend, U.S. debt was downgraded, and after a strong rebound from recent lows, it’s likely the market will pause next week. If that happens, I’ll look to open a few new positions at more attractive prices. Let’s give it a try.

I’m placing BUY orders for the following:

60 shares of PAY at $35.10, first stop loss at $13.90

5 shares of FIX at $429.00, first stop loss at $395.00

9 shares of IESC at $245.00, first stop loss at $219.00

95 shares of BTSG at $22.00, first stop loss at $19.90

140 shares of DCTH at $15.10, first stop loss at $12.90

These are limit buy orders that will trigger only if prices pull back to my targets. If all five are filled, I’ll be about 50% invested. Let’s see how this plays out.

10X Underpriced Growth Portfolio

This portfolio is currently 100% in cash, with a 0% return YTD, underperforming the S&P 500 by 6%. It’s designed to hold up to 10 stocks at a time.

Here’s what I plan to buy this coming week:

145 shares of PAY at $35.10, first stop loss at $29.90

222 shares of KNSA at $22.50, first stop loss at $19.90

210 shares of SYM at $24.00, first stop loss at $20.50

480 shares of DLO at $10.40, first stop loss at $8.60

53 shares of SN at $94.20, first stop loss at $74.90

Also here, these are limit buy orders that will trigger only if prices pull back to my targets. If all five are filled, I’ll be about 50% invested.

That’s it for this week — let’s see what opportunities the market gives us next.

If you enjoyed the content, please like or share this post.

Thanks for reading!

-

Important:

this is not investment advice. Consult a licensed financial advisor before making any investment decision.