From Holidays to Market: Launching a New "Underpriced Growth" Portfolio

September 8, 2024 Update

I’m back from my holidays in the USA where I had the chance to see many of the brands from the companies that I trade. A journey I enjoyed a lot.

I’m starting a brand new portfolio. More on this below.

Now let’s get back to the markets.

MACRO

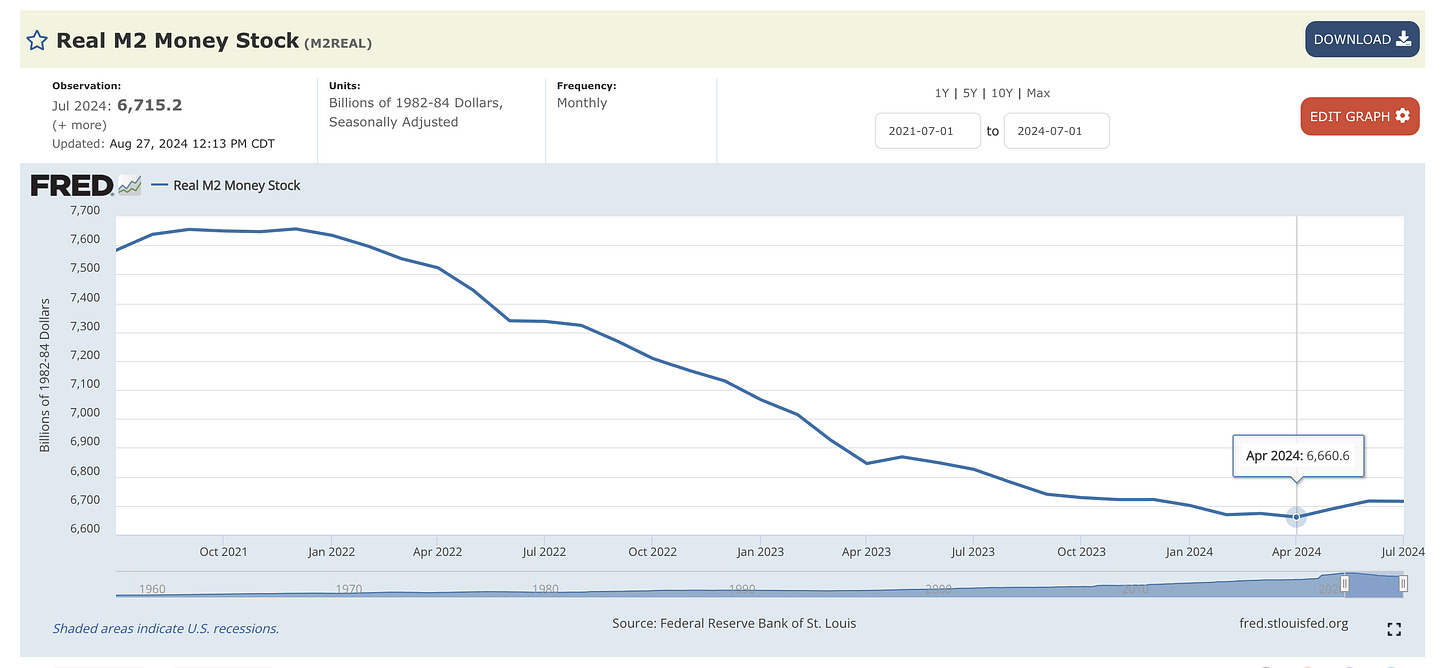

Liquidity: M2 has started to grow again, although at a low pace. Yet M2 stopped declining back in April:

The worst in terms of monetary restriction should be behind us.

CREDIT

Although the consumer in the US is suffering as demonstrated by Credit Card delinquencies (very high by historical standards) and Personal Saving rates (very low by historical standards), financial conditions have been improving and are away from alarming levels:

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.