Happy Holidays, everyone.

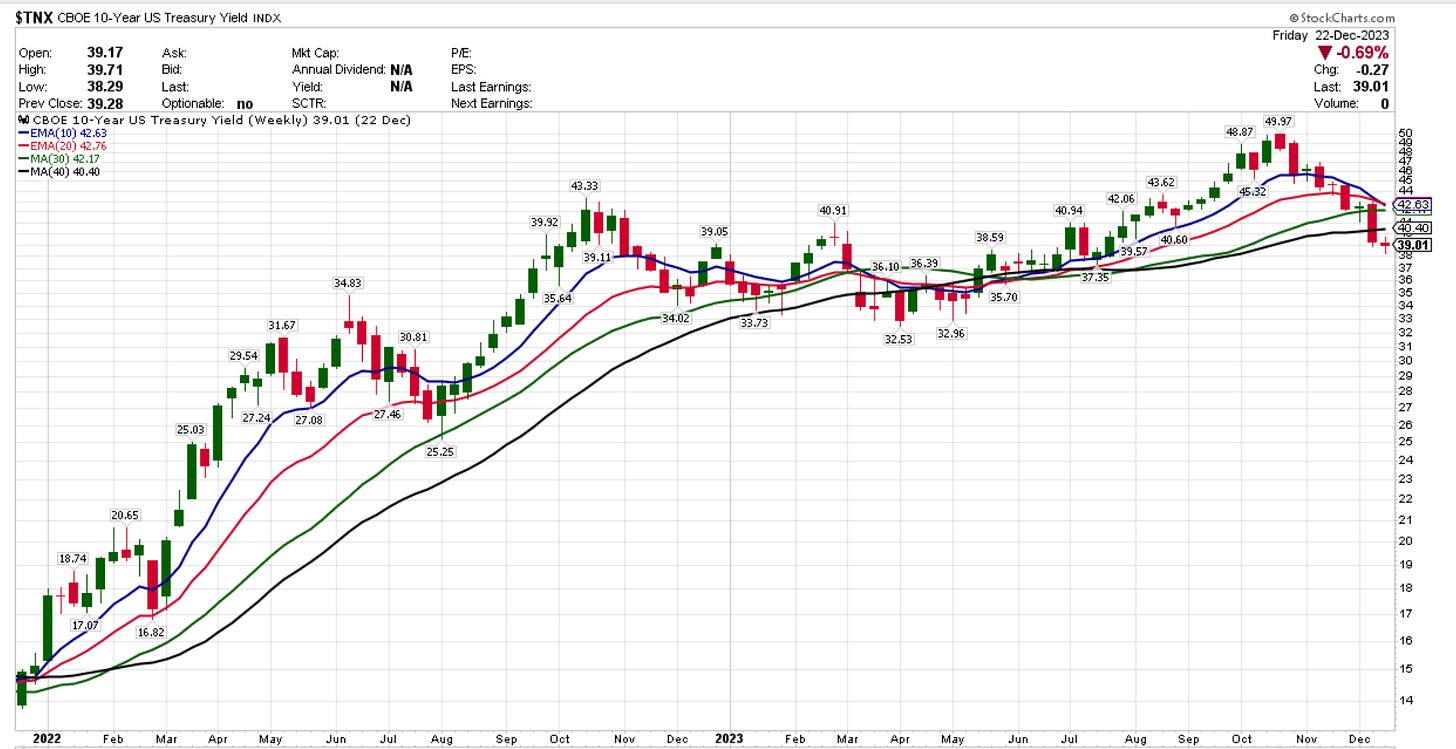

The driving force behind the S&P 500's recent performance appears to be the expectations surrounding future interest rates. With inflation returning to "normal," the 10-year Treasury yield has been declining, providing a boost to equities.

Will this trend persist? The evolution of inflation figures will be key. I project that we won’t witness significant shifts in the coming months: inflation should continue to cool, albeit at a slower pace, potentially limiting the upward trajectory of stocks.

The Nasdaq has experienced a remarkable rise, climbing for eight consecutive weeks and amassing an impressive +18% gain from its October lows.

Currently, the Greed & Fear Index is in the “Extreme Greed” territory. Below is the “Greed & Fear Index” chart:

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.