Crosscurrents and the market environment

What I am doing

It's been a while since my last email.

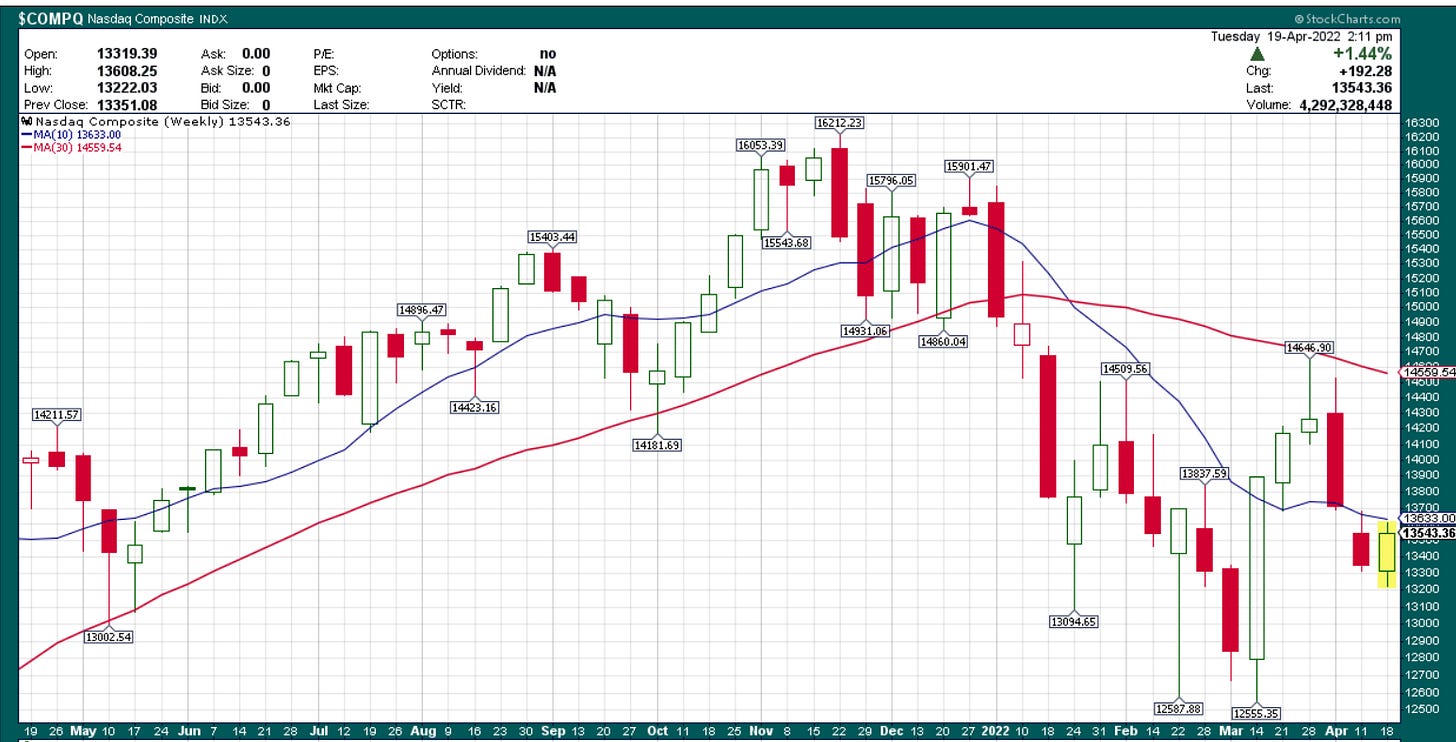

The market has been a roller coaster and especially growth stocks, my favorite style, have been crushed by the market.

Image: the NASDAQ last 12 months and 10 and 30 weeks moving averages. Still a bearish outlook.

Now, I invest for the very long term and so in the long term companies with high growth and earnings engi…

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.