Very quick update this week.

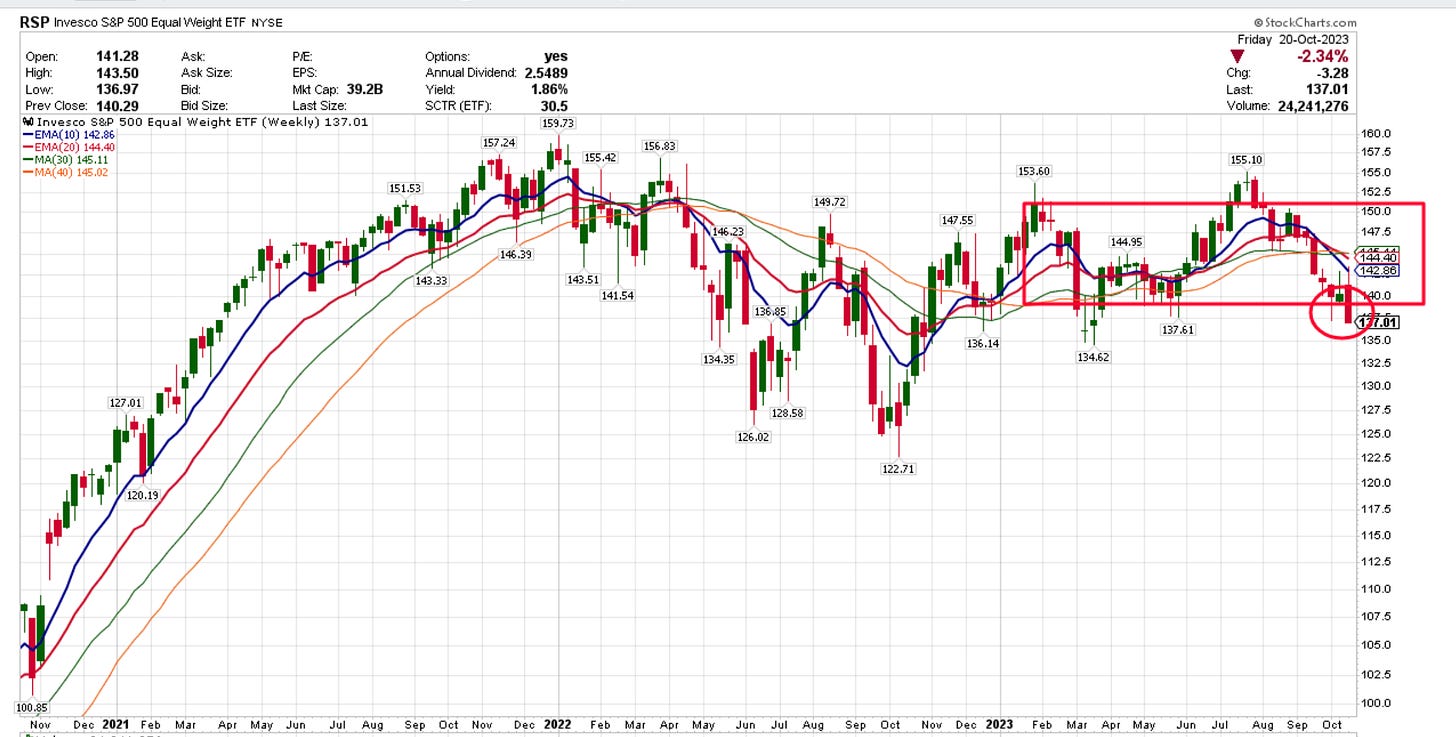

As you can see above, the equal-weight Sp500 is breaking below the consolidation area I have been highlighting for months now. The look is not good. We either bounce up from here or… more pain will come.

Looking around there is little to be optimistic about over the short term.

The 10-year treasury yield keeps grinding higher. I personally expect to come to an end relatively soon, but that moment has yet to come:

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.