What a crazy week we had. The Israel–Iran conflict has ended. I hope. Oil fell below $70 again.

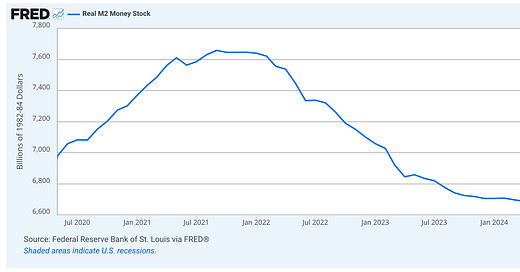

US liquidity is still rising at a steady pace. Global liquidity is climbing too.

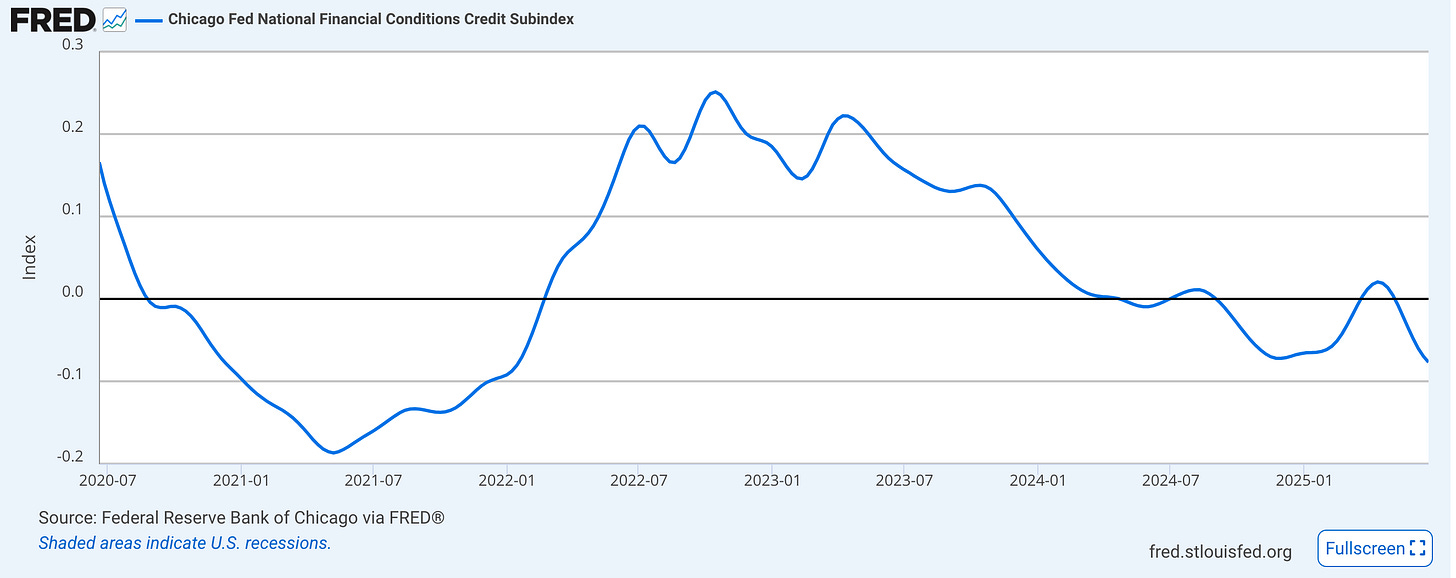

Financial conditions are the best in 3–4 years. Cheap credit is a boost for the economy and stocks.

What’s next? New US tariffs could push prices up. The Fed will wait for hard data before cutting rates. The Truflation index points to mild inflation ahead.

I expect this to be temporary. It will take a few months for tariffs to work through the system.

US economic signals are mixed, but nothing alarming. Q2 and Q3 GDP forecasts sit near +2% year‑over‑year.

Inflation expectations show up in the 10‑year Treasury yield. It’s been in a downtrend lately and now hovers around 4.3%

One more data point: US capital expenditures jumped in Q1 2025. Companies are investing more—likely in AI and data centers. If this acceleration holds, it means firms see growth opportunities they want to seize.

All in all, it’s a strong backdrop for stocks.

INDEX

Technology led again. The NASDAQ gained 4.5% last week. It hit new highs and beat the S&P 500.

SECTORS & INDUSTRY GROUPS

Fastest‑growing sectors in recent weeks:

Communication Services

Information Technology

Financials

Consumer Discretionary

Industrials

Energy lagged last week.

Top industry groups:

Semiconductors & Semiconductor Equipment

Technology Hardware & Equipment

Transportation

Financial Services & Banks

Media & Entertainment

Real Estate Management & Development

Capital Goods

Telecommunication Services

Consumer Durables & Apparel

This picture shows a market that expects the economy to pick up and the Fed to cut rates sooner rather than later.

PORTFOLIOS

10X LONG TERM POT

I added META, NXT, AMD, NVDA, TSM, and MU two and a half months ago, right in the middle of tariff madness. These picks are up about 26% on average. I’m holding for now.

Since May 2021, this portfolio has returned 64.7% (12.8% annualized), beating the S&P 500 by 17 points.

10X 2025 Picks

This one is underperforming. YTD: –7% vs. S&P 500 +5%.

If markets rally, its higher beta should help. Let’s see what the next six months bring.

10X MOMENTUM PORTFOLIO

Below is how the Portfolio looks right now.

All positions are in the green. Cash sits at 36%. ROI to date is 126% (44% annualized).

This week’s plan:

Place a buy‑stop for 4 shares of FIX at $536.

Place a buy‑stop for 12 shares of COIN 0.00%↑ at $355, with a stop‑loss at $255.

10X UNDERPRICED GROWTH PORTFOLIO

Here I have been cautious and my cash position is substantial. My open positions are all in the green as shown below.

Next step: fill positions in SYM, HOOD, ZETA, and DLO at the open:

100 shares of SYM

56 shares of HOOD

315 shares of ZETA

450 shares of DLO

10X BEST OF ARKK PORTFOLIO

My top 10 ARKK picks have been stellar. Up 87% in eight months (143% annualized). That beats the ARKK ETF by 40 points!

I’ll rebalance in two weeks, per our original rules.

That’s all for the week!

Let’s see what next week brings.

-

Important:

This is not investment advice. Consult a licensed financial advisor before making any investment decision.