Important: this is not investment advice. Consult a licensed financial advisor before making any investment decision.

-

Technicals

First the equal-weight SP500:

The chart looks concerning as the price is just below the 10 and 20-week moving averages.

At the same time, defensive stocks are getting stronger. See below the equal-weight Consumer staples going up on increasing volume:

The same is for Utilities, Energy, and Healthcare which are improving while Industrials and Technology are worsening.

This a sign that the market is worried about recessionary implications over the next months.

Around the world, European stocks look better. See Germany:

Also, Portugal looks very good:

Looking across many asset classes, Gold and Gold miners are showing strength.

If financial conditions deteriorate from here then Gold and Bitcoin will outperform:

The Macro:

Overall we are in a sideways market that has transitioned from inflation fears to recession fears.

Lots of bad news have been thrown at the market lately (ex. SVB Bank crisis, OPEC oil price shock last week) and the market has not collapsed.

On the macro side, what I am watching closely is the health of credit conditions.

Unfortunately, we have reached a level only seen just before the start of the previous recessions in 1990, 2001, and 2008.

See below Tightening Standards for Commercial and Industrial Loans to Small Firms:

Grey areas represent recessions. The picture is very similar for Medium and Large Firms Tightening Standards:

Getting a loan is getting much more difficult. Exactly the mechanism the FED is using to slow down the economy.

My conclusion

A slowdown is coming and nobody knows how severe it will be. That’s why the market has been indecisive.

The entire big bet on the table is on “how severe” the slowdown will be.

Over the past 3 months, Technology, Consumer Discretionary, and Communications Services have been the strongest sectors which means the market has been betting that the worst is behind us.

For sure, most likely the interest rates hiking cycle is over

If incoming economic data won’t be too bad, we may be climbing a wall of worries on the markets. If data come in bad or very bad, then fears may take over and the market correction will materialize.

That’s the thin line we are walking on right now.

I can only be aware of both scenarios and be ready to either become more aggressive or more defensive.

There is no clear trend right now, yet.

What I am doing with my POTs (Portfolios)

Regarding my “never touch” POTs, I am doing nothing right now and I’ll keep waiting for a more clear environment before adding.

Momentum POTs

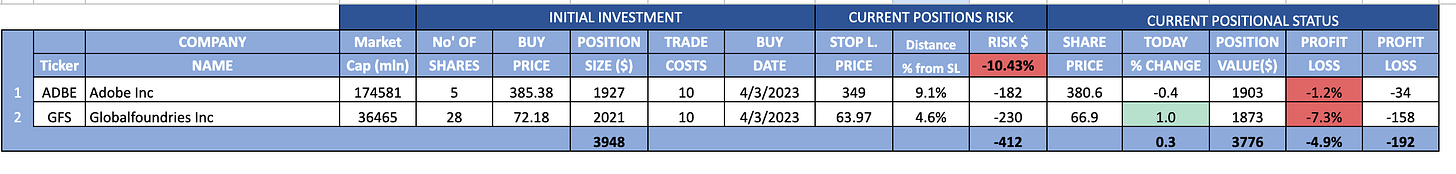

This week I started my 10X LARGE CAP MOMENTUM POT which I’ll be managing here. I added ADBE 0.00%↑ and GFS 0.00%↑ last week as both triggered my "stop buy order". Here is what the POT looks like right now:

As the technology sector lost momentum last week the POT is in the red for the week. Here is what the entire POT looks like today:

I am about 60% in cash.

For this week I am doing nothing.

Now let’s dive into my 10X SMALL CAPS MOMENTUM POT (for paid subscribers only)

I have 5 open positions for an average 15% gain right now. I am at 40% cash and 60% invested.

Below are the details.

If you are not a paid subscriber, join us at $5/month to support my research. Use the 7-day free trial to get access to my small cap both Long term and momentum POTs.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.