Important: this is not investment advice. Consult a licensed financial advisor before making any investment decision.

-

"This is the most uncertain environment for markets and the global economy in my 45-year career."

Words from the billionaire investor Stanley Druckenmiller, who was George Soros’s right-hand man that helped break the Bank of England in an assault on the pound in 1992.

My best guess is that we are entering a slowdown of the economy after the hangover induced by the crazy money printing by central banks plus the incredible government spending to recover from the COVID-19 crisis.

Now Central banks are inducing a “soft landing” slowing down the economies but it is impossible to predict the impact on the economy: when and how much damage.

We are entering an economic slowdown from a position of strength (strong economy).

GDP in the US for the first quarter is actually positive (!) so we need to postpone the recession… again.

You can find analysts saying that the recession may even be behind us and that the bottom of the cycle was in last December (check the article here).

I am still in the “soft landing” camp. Yet, we need to look at what the markets do, stay flexible and adapt.

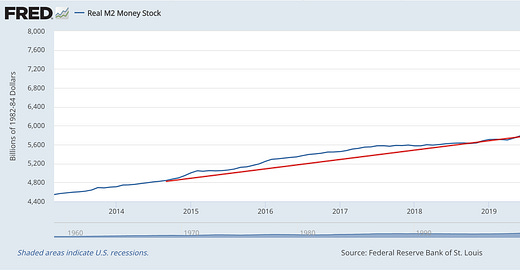

One of the most reliable indicators of future economic activity is the amount of liquidity in the economy as measured by M2:

The amount of money keeps declining which is bad for future business activity and for equities.

Lending to businesses is declining, credit conditions keep getting tighter. Inflation may get stickier over the next few months.

Not the best environment to invest in equities.

Now let’s look at the markets.

The Equal weight SP500

On the monthly chart, we are above a rising 10-month moving average. Yet the market is clearly indecisive and momentum is lacking.

When looking at equity sectors, only the Consumer Staples group looks to me in a clear uptrend, which speaks to a market that is conservative and preparing for a recession:

The technology sector is still in a mid-term uptrend but consolidating and lacking in volume (conviction):

In a nutshell

the most anticipated recession in history is not here yet

economic data is mixed, with some signs of strength like better-than-expected earnings reports (ex. META 0.00%↑ & MSFT 0.00%↑)

leading indicators like liquidity, lending, and credit tightening keep deteriorating but... the tightening cycle is getting closer to an end

nobody knows how the whole thing will pan out

then the US market stays in a very cautious mode and so am I

MY POTS (PORTFOLIOS) UPDATE

I manage 4 portfolios here that I call “POTS”.

Here are my two investment portfolios for the long-term:

I am in the process of creating two long-term portfolios for my children. These portfolios are designed to only receive additions and never sell any assets. The aim is to identify outstanding companies and allow them to flourish over time. I increase my investments in the companies that exhibit growth while avoiding those that do not.

10X CAPITAL FREE POT: [link] | -26% since inception | +11.7% YTD

10X SMALL BETS POT | -8% since incept. | +11% YTD

And here are my two investment portfolios for the short/mid-term:

I recently started 2 Momentum POTS trying to capture mid-term trends from strong companies as described in my methodology here.

10X FREE LARGE CAP MOMENTUM POT [link]

10X SMALL CAPS MOMENTUM POT

Access to both SMALL CAP Portfolios is restricted to subscribers only.

What I am doing with my POTS this week.

I am adding RMD 0.00%↑ to my 10X FREE LARGE CAP MOMENTUM POT and FSR 0.00%↑ to my 10X CAPITAL FREE POT.

I am also adding a micro-cap to my 10X SMALL CAPS MOMENTUM POT. Details below.

10X FREE LARGE CAP MOMENTUM POT: I am creating a stop buy order for 8 shares of RMD 0.00%↑ at $241. If triggered, I am placing a Stop Loss at $213 (-11.6%). I am raising my Stop Loss for ADBE 0.00%↑ to $355 and raising my Stop Loss for OTEX 0.00%↑ to $34.9

10X CAPITAL FREE POT: I am adding FSR 0.00%↑ at the open

Resmed (https://www.resmed.com/en-us/), a medical devices business valued at 35B (healthcare sector), is breaking out of a long period of consolidation. The company is growing above 10% YoY with solid fundamentals and a fair valuation. Here I am more interested in what the stock may do over the next few months.

Fisker (https://www.fiskerinc.com/) is an EV manufacturer that is launching in Europe in a few days. This may be a key moment in the history of this young company and that may finally reverse and start an uptrend.

Their first Car (The Ocean) is really cool and reviews are promising. Last, the company is moving from money burning to money making mode (profitability).

From now on the content is exclusive for supporters. Try 1 week for free to access all exclusive content.

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.