2023 Could Be a good Year for the Stock Market Despite a Murky Economic Landing

Update on the amrkets and my 10X MOMENTUM POT

Important: this is not investment advice. Consult a licensed financial advisor before making any investment decision.

-

Macro

Will the US experience a severe recession in 2023? Will the inflation keep heading south fast enough?

The worst scenario would be having sticky inflation that does not come down anymore at some point and an economy that does slow down, impacting earnings and then market valuations.

I can tell you that I have listened to super experts and you can get anything from “very likely we’ll have a soft landing” to “we are heading to a disastrous contraction of the economy”.

In a worst-case scenario, we should see the SP500 touch lower lows compared to what we saw in 2022.

The best case scenario would see inflation keep going down and a negligible slowing down of the economy, with a limited impact on earnings and the stock market.

In this best case, we should see a choppy market for some time but essentially a market that keeps heading up until a more clear understanding of inflation and recession will be available.

Probably will be somewhere in between these two cases and the best course is to follow what the market does and adjust accordingly.

My take in this debate is that higher interest rates have been applied to a super powerful economy and because of this the impact on the economy will be softer, compared to other occasions from the past.

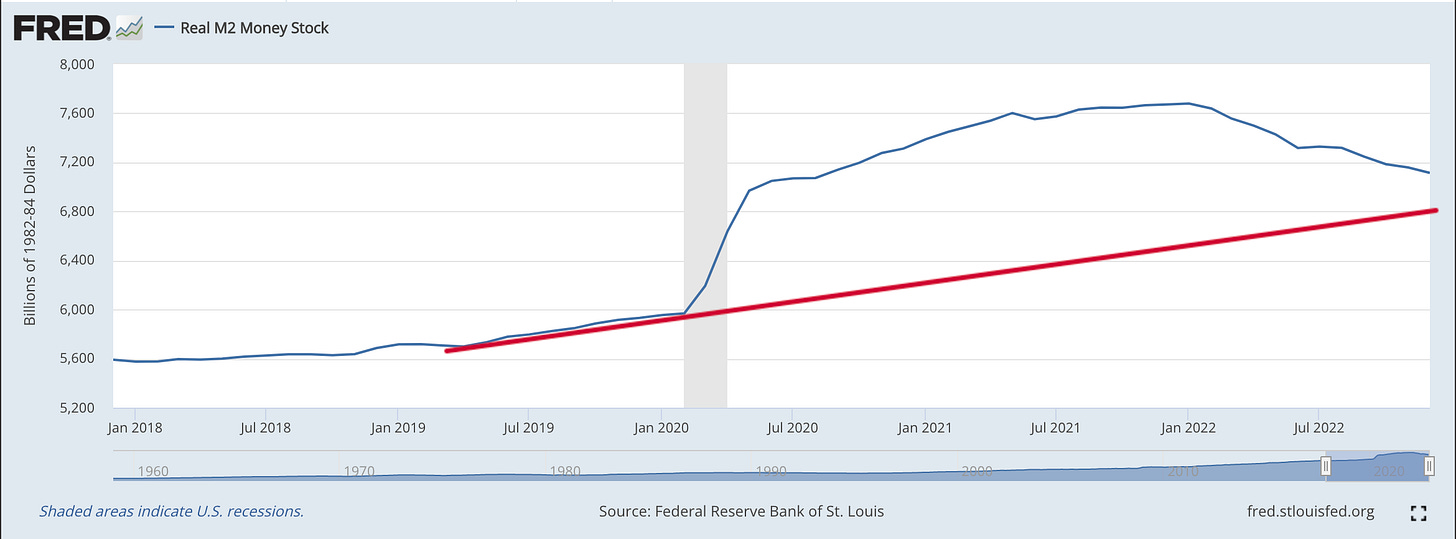

Have a look below at M2, an indicator of available money in the economy: it has been declining since January of 2022 and still has not reached a level that looks more logical since the crazy acceleration it had during the pandemic.

Bottom line: M2 has been decreasing (quantitative tightening) but still we have a lot of money in the system, which has created a cushion for the economy.

See below how, when credit conditions become tighter (line going up) a recession arrives some months after.

But, even if banks have been tightening over the past 6 months, the lending activity is actually going up! See below the total amount of loans to large and mid-sized companies:

Why? Probably because companies are trying to get money as soon as possible before it becomes more expensive. Also, because there is still enough money in the system which speaks to a higher probability of not having a horrible landing in 2023.

Inflation

Next Tuesday, February 10th, we’ll get the new official inflation data point for January 2023.

If for whatever reason the number is bad or very bad, then we could see a strong sell-off in the markets.

If the number is aligned with expectations… we won’t see a significant market reaction.

A very good number of course would propel the market up. Why? because then the FED may stop raising rates for some time.

The Market (Nasdaq weekly chart)

After 5 very good weeks, we had a red week. Now, the Nasdaq has been above its 200-week moving average (green line) for the last 3 weeks. It’s the first real attempt at breaking out of the downtrend that started in January 2022. Very likely we’ll see a retest of the 200-week moving average at around 11350: if it holds, we may be out of the downtrend. Otherwise…

Let’s see what next week brings us.

Now, a quick update on my 10X Momentum weekly portfolio.

I designed a strategy to invest 10.000 USD using weekly charts and strict rules on buying and selling.

I was stopped out from one of my positions last week. Now I have 6 open positions in the POT and about 40% in cash.

Please find below details on each position.

If you want to follow along, become a premium subscriber.

Have a great week everybody!

10X MOMENTUM POT update below

Keep reading with a 7-day free trial

Subscribe to 10X CAPITAL POT to keep reading this post and get 7 days of free access to the full post archives.